Civil Asset Forfeiture: Forfeiting Your Rights

How Alabama's Profit-Driven Civil Asset Forfeiture Scheme Undercuts Due Process and Property Rights

This report was produced by Alabama Appleseed and the Southern Poverty Law Center.

The following is an excerpt of the report. Download the entire report here.

On August 15, 1822, the brig Palmyra, an armed privateer commissioned by the King of Spain, was captured on the high seas by the USS Grampus. Accused of violating the 1819 Piracy Act, the Palmyra was sent to South Carolina to await judgment.

Though the crew was “guilty of plunder,” no law existed under which its members could be punished, so no one was convicted of any crime. The Spanish government, claiming its flag had been “insulted and attacked” and its property stolen, demanded that the Palmyra be returned to its owner.

The U.S. Supreme Court determined that the ship was properly forfeited, ruling that it was permissible for the state to take property that had facilitated criminal activity, despite the fact that no person was convicted of a crime.

Nearly two centuries later, law enforcement agencies across America are using a process known as civil asset forfeiture to take and keep billions of dollars in currency, vehicles, houses, land and weapons – even items like TVs – under the same legal reasoning. This property is taken not from pirates who lie beyond the jurisdictional reach of the United States, but rather from ordinary people who can easily be taken into custody, charged and tried if the state believes they committed a crime.

Today’s use of civil asset forfeiture, in other words, is unmoored from its historical justification of imposing penalties when authorities could not convict a person suspected of crime. This lack of a link to the original use of civil forfeiture raises numerous questions, including whether it is the wrong process to meet the state’s otherwise legitimate interests of confiscating the fruit of crimes.

In the 1980s, with the advent of the War on Drugs, civil asset forfeiture was sold to the public as a tool for taking the ill-gotten gains of drug kingpins. In practice, however, it has become a revenue stream for law enforcement – but one whose burden falls most heavily on the most economically vulnerable.

In Alabama, as in numerous other states, the process is opaque, mostly applied to people who are not drug kingpins, and fraught with enormous potential for abuse.

This study found that in half of the 1,110 cases examined in Alabama, the amount of cash involved was $1,372 or less. This suggests that prosecutors have extended the use of civil forfeiture beyond its original intent of pursuing leaders of international drug cartels. And since typical attorney fees add up to well over $1,372 – often running into the thousands for the multiple pleadings and court appearances a civil forfeiture case can entail – this means law enforcement can take these relatively small amounts of money from Alabamians, secure in the knowledge that they will never be asked to return it. Indeed, this study found that in more than half the disposed cases (52 percent), the property owner never attempted to contest the forfeiture, resulting in a default judgment – an easy win – for the state.

Making matters worse, there is no state law requiring agencies to track or report the assets they seize – and no requirement that they account for how they use the property or the proceeds that are subsequently forfeited.

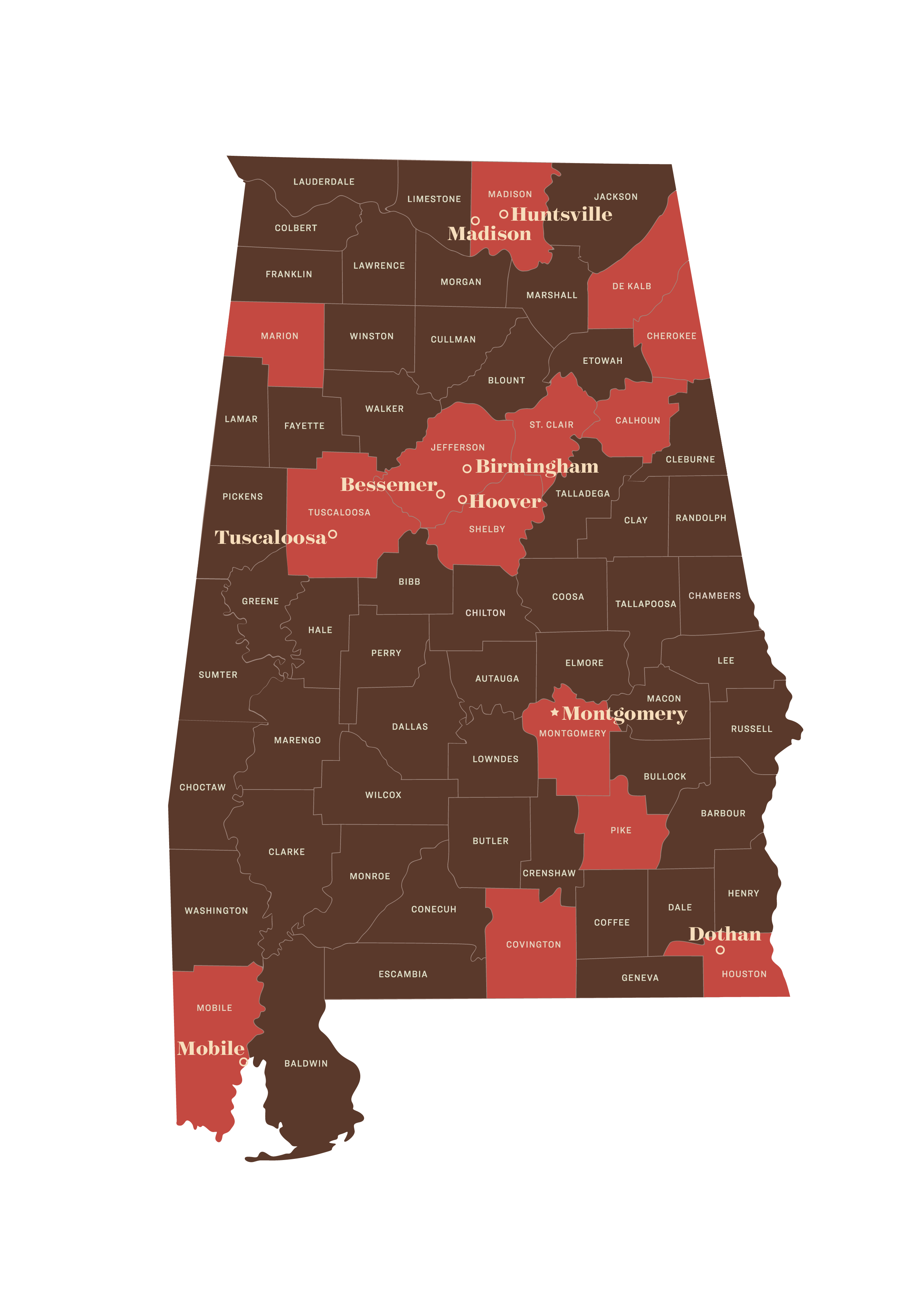

To track the property seized and forfeited under civil asset forfeiture laws in the state, Alabama Appleseed Center for Law and Justice and the Southern Poverty Law Center reviewed court records in the 1,110 cases filed in 14 counties in 2015, comprising approximately 70 percent of all such cases filed statewide that year.

- Seventy agencies – including police departments, city governments, district attorneys’ offices, sheriffs’ offices and inter-agency drug task forces – were awarded $2,190,663 by the courts in 827 cases that were disposed.

- Courts awarded law enforcement agencies 406 weapons, 119 vehicles, 95 electronic items and 274 miscellaneous items, including gambling devices, digital scales, power tools, houses and mobile homes.

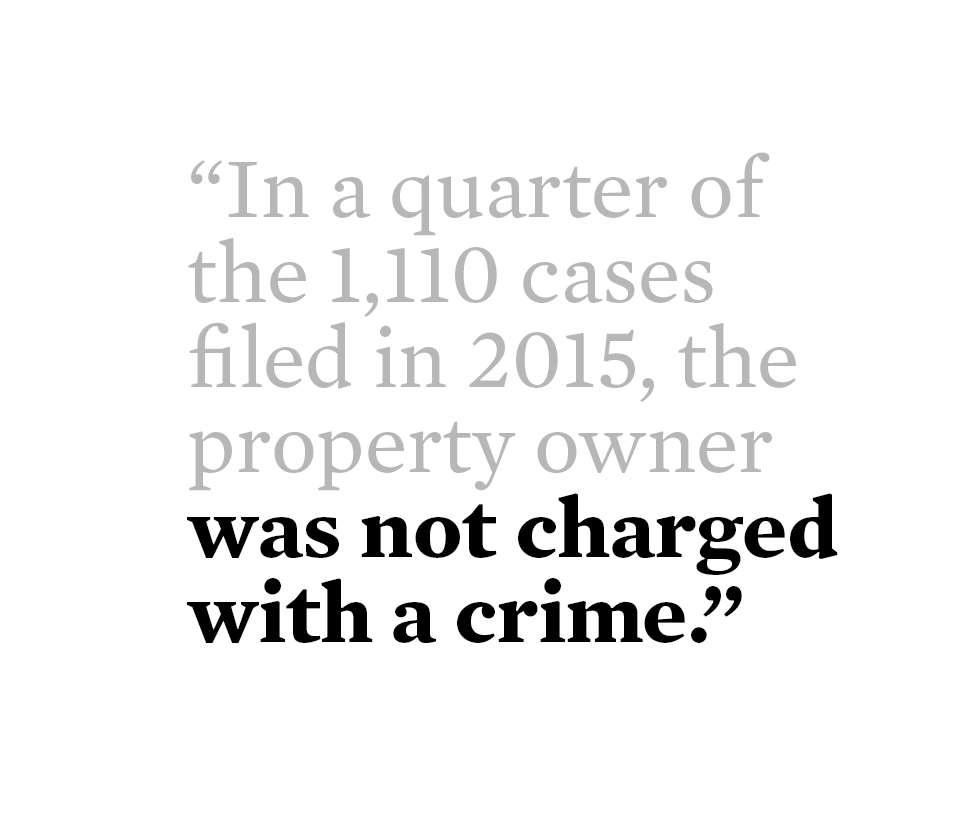

- In 25 percent of the cases, the property owner was not charged with a crime linked to the civil forfeiture action. The state won 84 percent of disposed cases against property owners who were not charged with a crime. Those cases reaped $676,790 for law enforcement.

- In 55 percent of 840 cases where criminal charges were filed, the charges were related to marijuana. In 18 percent of cases where criminal charges were filed, the charge was simple possession of marijuana and/or paraphernalia. In 42 percent of all cases, including those where there were no charges, the alleged offense was related to marijuana.

- In 64 percent of cases where criminal charges were filed, the defendant was African American, even though African Americans comprise only about 27 percent of Alabama’s population.

Appleseed and the SPLC also reviewed information about all 1,591 civil asset forfeiture cases filed across the state in 2015. Of the 1,196 that had been resolved by the time of this review in October 2017:

- 79 percent resulted in favorable verdicts for the state.

- 52 percent of disposed cases were default judgments, meaning the seizures were never challenged in court by the individuals from whom assets were taken.

Civil asset forfeiture cases reside in a peculiar legal netherworld premised on the fiction that objects themselves can be “guilty” of criminal activity. In the time of the Palmyra, civil asset forfeiture laws enabled the government to recover damages and punish offenders by taking the wealth of individuals who were personally beyond the jurisdiction of the United States.

The practice today hardly resembles those origins. Beginning in the 1980s, Congress enacted laws that essentially created a financial incentive for law enforcement to prioritize the War on Drugs. States followed suit by expanding their use of civil forfeiture under state laws.

In addition to the $2.2 million in state forfeitures in 2015, Alabama law enforcement agencies netted $3.1 million from federal forfeitures.

Under Alabama law, a law enforcement officer can seize property if there is probable cause to believe it is tied to certain criminal activity. The owner then has to enter civil court to litigate the permanent loss of title, regardless of whether he or anyone connected to the use of the property in a crime is convicted of, or even charged, with a crime. In most cases, the ultimate burden of proving the property is “innocent” then rests with its owner, turning the notion of “innocent until proven guilty” – a cornerstone of the American justice system – on its head.

While criminal convictions rest on proof “beyond a reasonable doubt,” the government’s standard of proof in a civil forfeiture case is “reasonable satisfaction,” a much lower hurdle. In practice, the “reasonable satisfaction” standard makes it extremely difficult, and often too expensive, for owners to wrest their property back once the state has taken it. Many owners don’t bother contesting forfeiture, often because the expense would be greater than the amount taken.

The payout structure of civil forfeiture creates a strong incentive for law enforcement to initiate civil asset forfeiture actions. Agencies are permitted to keep up to 100 percent of the proceeds of forfeited property under Alabama law. Under a separate U.S. Justice Department program known as “equitable sharing,” they typically keep 80 percent of the proceeds from forfeitures awarded by federal courts, with the remainder going to the federal government. As this report shows, forfeiture proceeds are typically divvied up among various local and state agencies, including the prosecutors’ offices that handle the cases in court.

With more than $5 million a year coming to Alabama law enforcement agencies through state and federal civil asset forfeiture laws, the profit motive can too easily overshadow the fair administration of justice.

The laws may have been initially intended to punish drug lords, but the results have been far different, snaring mostly low-level offenders and many individuals who are never charged with a crime in the first place.

In effect, civil asset forfeiture has become a money-making venture for law enforcement, to varying degrees among the thousands of jurisdictions. One national study found that more than 60 percent of the 1,400 municipal and county agencies surveyed across the country relied on forfeiture profits as a necessary part of their budget, leading the author to conclude that they were “addicted to the drug war.”

Everyone agrees that no one should be allowed to profit from criminal activity.

But there is also widespread agreement across the ideological spectrum that civil asset forfeiture laws violate the most fundamental tenets of due process in our democracy and are thus manifestly unfair to property owners. In addition, they create the potential for abuse and erode trust in law enforcement.

It’s time for Alabama to end this abusive practice.

Fortunately, a system already exists to ensure that individuals who commit crimes cannot keep the proceeds of their criminal activity.

That system – known as criminal asset forfeiture – combines the process of trying a person and their assets into a single criminal prosecution. If the person is found guilty of the crime, any assets used to facilitate it, and all profits generated by it, are forfeited. With this shift in policy, innocent Alabamians would no longer need to defend their property from the government.

We urge state lawmakers to implement the following recommendations:

- End civil asset forfeiture and replace it with criminal asset forfeiture;

- Strengthen protections for innocent property owners such as spouses, parents and creditors whose property was the product of, or facilitated, alleged criminal activity without their knowledge or consent;

- Require annual, centralized reporting on all seizures and forfeitures and what law enforcement agencies spend forfeiture proceeds on;

- Disincentivize policing for profit by requiring the government to distribute forfeiture proceeds to Alabama’s General Fund instead of allowing law enforcement agencies to keep them; and

- Prohibit Alabama law enforcement agencies from receiving proceeds from federal forfeiture actions.

Civil asset forfeiture is, at its core, a legal process through which an individual’s property becomes the government’s property. It is accomplished in two distinct steps: seizure, when police take possession of property, and forfeiture, when a civil court determines the government can keep it.

Police are empowered to seize cash or other assets based on probable cause that they are connected in some way to certain criminal activity, even if no one is ever charged with a crime. In practice, this means a single police officer can take money and property based on the mere suspicion that it was used in the commission of a crime or that it was derived from certain criminal activity.

In all criminal cases, the burden is on the government to prove beyond a reasonable doubt that the accused is guilty. But freed from any connection to criminal prosecution, the litigation of property under Alabama’s civil forfeiture laws involves different standards of proof. Specifically, while the initial burden falls on the prosecutor, the low standard of proof in effect means that the suspect or innocent owner claimant must carry the burden of proving that the property is “innocent” of the alleged crime. This turns on its head the notion of “innocent until proven guilty” – a cornerstone of the American justice system – and seriously undermines the property and due process rights that are foundations of our nation’s democracy.

Even if a property owner is never charged with or found guilty of any crime, he might still need to hire a lawyer to get back the cash or other assets seized.

That’s what happened to Jamey Vibbert, a car dealer, past president of the local Rotary Club and member of the Chamber of Commerce in Dothan, Ala. His troubles started in 2015 when $25,097 mysteriously vanished from one of his bank accounts. A few days later, an investigator showed up at Vibbert’s office and told him that he had been indicted in connection with the sale of two vehicles that were involved in a drug investigation. One of his customers had allegedly used illegal drug profits to finance the purchases. A prosecutor later told the Dothan Eagle that the allegations against Vibbert were “kind of akin to money laundering because you know you’re taking dirty money.”

Read more about Jamey Vibbert from Alabama Appleseed

In addition to indicting Vibbert on the completely novel legal theory that he had violated the law when he titled the cars to someone other than the customer who paid him, authorities had seized the money he received for the vehicles, claiming it was the fruit of illegal activity.

Vibbert faced two separate legal proceedings: a criminal trial on the title fraud charge and a civil action related to the state’s attempt to having his money forfeited. At the criminal trial, the state claimed that Vibbert had titled the cars to a third party to help the buyer avoid having them seized by the state. Vibbert countered that he frequently titles cars to third parties, and the judge observed that he himself had recently paid for a car and put the title in his son’s name. He found Vibbert innocent.

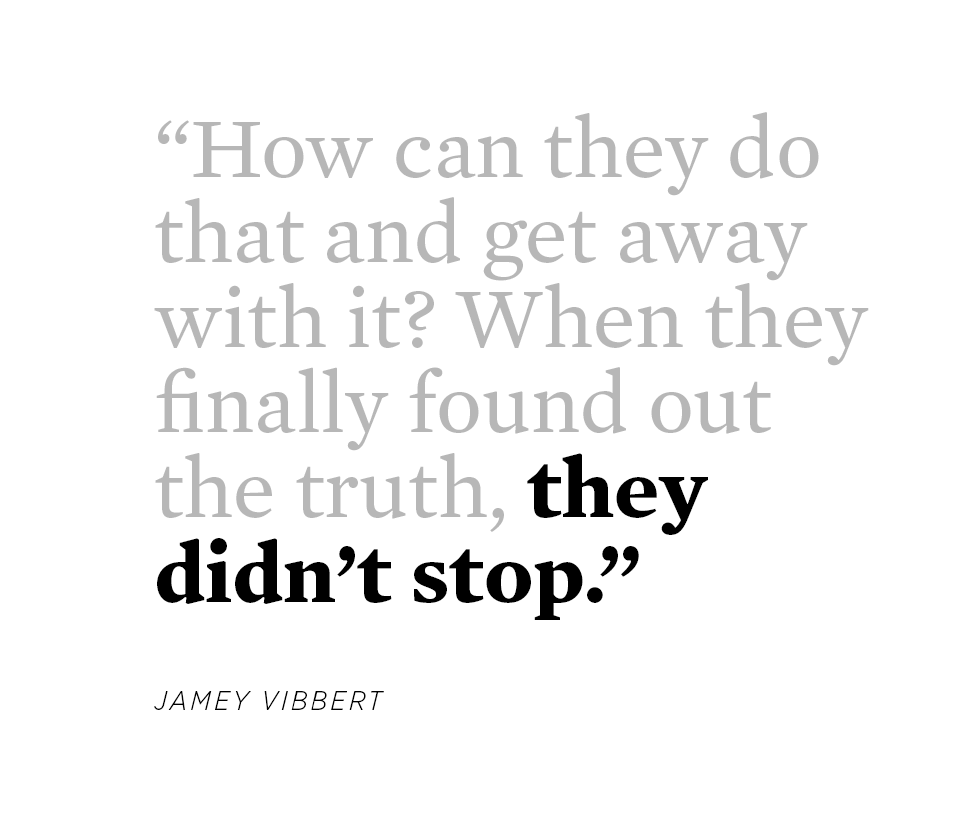

The prosecutor who argued the case apologized to Vibbert, but the ordeal was far from over. Even though he had been cleared of wrongdoing, Vibbert was forced to hire a lawyer to fight for his cash in the civil forfeiture action after prosecutors refused to return it. Finally, a judge ordered its return, but he lost about a third of it to legal fees.

By then, Vibbert had lost his dealership – and his reputation. He dropped out of the Rotary Club. He stopped going to church for a year and withdrew from neighborhood social activities. He fell behind on house payments, and the bank foreclosed on a property he owned.

Eventually, he was able to open a new dealership, but because of the damage to his reputation, Vibbert, who used to love working the floor as a salesman, now keeps to a back office and deals with customers as little as possible.

“It’s still a nightmare,” Vibbert said. “It hasn’t ended. I worked so hard to build what I had. And the thing is, how can they do that and get away with it? When they finally found out the truth, they didn’t stop. They didn’t stop! It was just like, ‘We don’t care.’”

Roots in the drug war

Though civil asset forfeiture has its roots in admiralty law from centuries past, its modern practice dates to the beginning of the War on Drugs. Seeking to strike at drug kingpins who were in some cases – like the pirates of the Palmyra – beyond the reach of U.S. courts, Congress in 1984 amended the Comprehensive Drug Abuse Prevention and Control Act to create, among other things, the Department of Justice’s (DOJ) Asset Forfeiture Fund.

Under previous versions of the law, the proceeds of forfeited assets went to the Treasury Department. After the 1984 amendment, however, control of forfeited assets was for the first time in law enforcement’s hands.

Its use soon began to soar. The DOJ’s Asset Forfeiture Fund’s yearly income increased by 4,667 percent between 1986 and 2014, from $93.7 million in 1986 to $4.5 billion in 2014. Between 2001 and 2014, the DOJ and the Treasury Department’s forfeiture funds together took in almost $29 billion from civil asset forfeiture. Their combined annual revenue increased 1,000 percent over that period.

As the power of civil asset forfeiture to enrich law enforcement without raising taxes or battling lawmakers over more funding became clear, states started to get in on the action. The DOJ’s “equitable sharing ” program allowed local and state agencies to be awarded up to 80 percent of proceeds from civil asset forfeitures that they funneled through federal agencies. States like Alabama changed their own laws, making it easier for law enforcement agencies to profit from civil forfeiture.

Alabama law

Today, civil asset forfeiture in Alabama is governed by a morass of statutes that, in practice, leave the property owner responsible for proving the property’s innocence.

One Prohibition-era law allows seizure of prohibited liquors and beverages along with “conveyances, vehicles, and animals used to transport” them, provided the court is convinced the prohibited items were being transported for purposes of illegal sales. A second law, governing controlled substances, states that property can be seized under a variety of circumstances, such as during the course of an arrest or if there is probable cause that it was used, or may be used, in violation of controlled substance laws – including misdemeanors like possession of a single marijuana cigarette.

A third law governs the seizure of pistols from individuals who commit or attempt to commit crimes while armed, those who are forbidden to possess firearms, and those who possess loaded and concealed rearms without a permit. A fourth relates to gambling, allowing for the seizure of money used as bets or stakes, as well as gambling devices, records and vehicles used in gambling offenses. There are laws devoted to covering “obscene materials”; computers; surveillance devices; and weapons used in nighttime deer hunting. The Alabama Comprehensive Criminal Proceeds Forfeiture Act permits forfeiture of “any property, proceeds, or instrumentality of every kind, used or intended for use” in connection with any felony offense or a misdemeanor prostitution offense.

The burden of proof varies slightly under these laws and depending on the type of property and who owns it. In general, to succeed in forfeiture proceedings, the government must make only a prima facie showing of evidence that demonstrates to a judge’s “reasonable satisfaction” – an amorphous standard whose meaning varies depending on the venue – that the cash, vehicle, firearm, home or other property was used to facilitate criminal activity or was the fruit of it. If the government successfully makes that showing, it falls to the owner to prove the property is innocent.

“Innocent owners”

In the case of the so-called “innocent owner,” in some instances prosecutors do have to meet a higher legal standard. An “innocent owner” is someone whose property, unbeknownst to that person, is used by someone else to facilitate a crime – for instance, a father whose son borrows his car and uses it to transport stolen goods, or a grandmother whose grandson uses her house as a base from which to sell drugs.

In most civil forfeitures involving alleged drug offenses, innocent owners bear the burden of proving that they had no knowledge of and/or did not consent to the offense and could not have reasonably obtained knowledge of the intended illegal use. In some innocent owner cases, however, the burden is on the state to prove the innocent owner or lienholder had knowledge of, or gave consent to, the use of the property in furtherance of a crime.

But just because some innocent owners have a greater chance of getting their property back in some crimes versus other crimes, it doesn’t mean that prosecutors won’t try to take it.

On January 22, 2017, Jessie Giles lent his truck to his son Antwan, a corrections officer at an Alabama prison. Antwan was detained for allegedly attempting to bring food into the prison in violation of prison rules, and a search of the truck turned up illegal drugs and a handgun. The state commenced forfeiture proceedings against the truck and the handgun, naming both Jessie and Antwan in the suit.

Jessie was not accused of any crime, but it still fell to him to hire an attorney to prove that he had no knowledge of, and did not consent to, Antwan’s alleged use of his truck to bring drugs and a firearm to the prison where he worked. Both Antwan’s criminal case and the forfeiture case against Jessie’s truck were pending as this report was being written.

Guilty until proven innocent

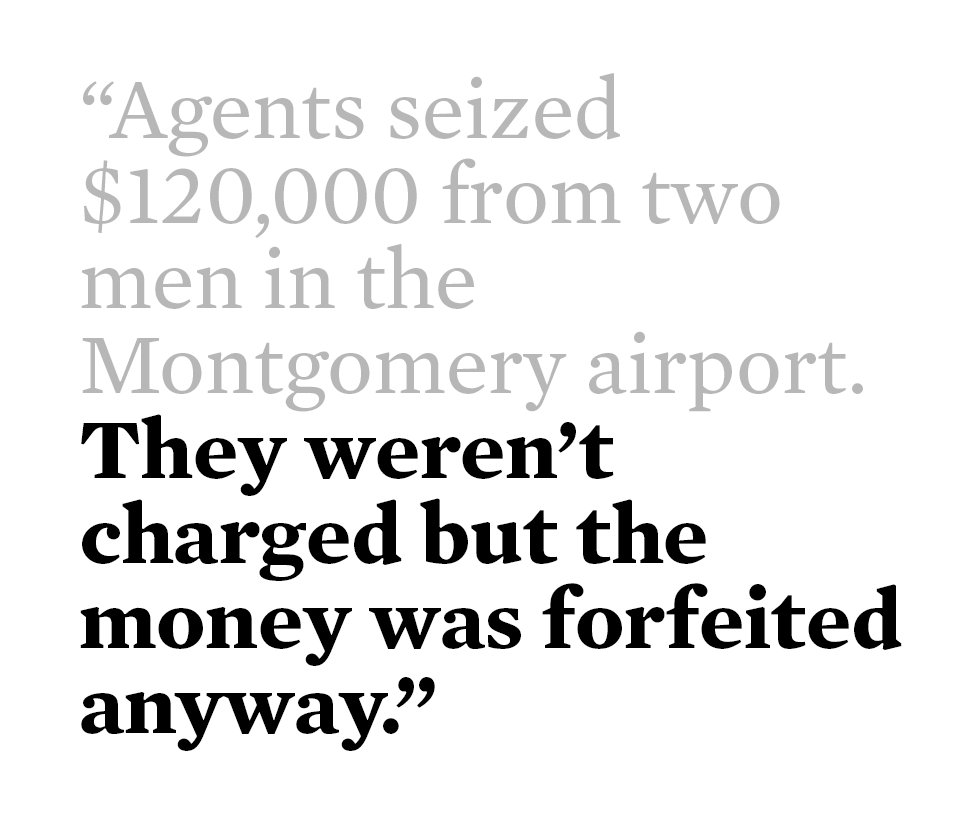

Then there’s the story of Michael Coleman and Jacquard Merritt, two young African-American men who walked into Montgomery Regional Airport with about $120,000 cash one day in 2005, and walked out with nothing.

TSA agents became suspicious after a search of Coleman’s carry-on bag turned up tens of thousands of dollars in cash. Then they searched Merritt and found rolls of cash in his carry-on bag. After they claimed to find a residual amount of marijuana, a drug-sniffing dog “alerted” to the cash, and the DEA seized it.

Coleman and Merritt said they planned to use the money to buy and flip houses – a common practice at the height of the housing bubble. Though they were never charged with a crime, a federal court insisted they defend the innocence of their money.

They never saw it again. Having cleared the low “probable cause” bar set for seizure by police officers, prosecutors took responsibility for the forfeiture litigation and made short work of persuading a federal judge that the money should be turned over to the government.

Though the court found the drug dog’s “alert” to be of little value, and even though the amount of marijuana found was minute, the court felt the government had shown by a “preponderance of the evidence” – that is, more likely than not – that the money was connected to illegal activity.

As with 25 percent of the Alabama state cases reviewed in preparing this report, Merritt and Coleman (whose forfeiture proceedings took place in federal court) were never charged with a crime in connection with the event that led to the forfeiture of their property. But because they could not prove that their money had come from “legitimate” sources, they lost it for good. Based solely on “a common sense view of the realities of normal life” – and commenting derisively that neither man wore business attire at the airport – U.S. District Judge William Keith Watkins ruled that the “facts all point to illegal activity,” more specifically, drug trafficking. “[P]eople in legitimate businesses, as opposed to drug rings, do not travel with this amount of cash,” Watkins wrote.

Montgomery attorney Joe M. Reed, who represented Coleman and Merritt, is still angry about the case. “Where’s the probable cause here?” he said. “You can’t arrest somebody for carrying an unknown amount of cash. There’s no charge for that. It’s not illegal. In America, you can carry as much cash on you as you can get your hands on.”

Indeed you can. And the government, with vast resources and low legal hurdles, can take it.

Who are the targets?

Civil asset forfeiture laws were sold to the public as a way to go after drug kingpins, hitting them where it really hurts by taking the fruits of their illegal activity. But early on, as many law enforcement agencies began to prioritize seizures, journalists and academic researchers began to note that the laws were being used against ordinary people, sometimes in a discriminatory manner.

A 1992 investigation by The Orlando Sentinel revealed that nine of every 10 motorists who were stopped and stripped of their cash by police in Volusia County, Florida, were either black or Hispanic, and three out of four were never charged with a crime. In 1994, a researcher observed that the profile of suspects who have their assets seized “differ[s] greatly from those of the drug lords, for whom asset forfeiture strategies were designed.”

A 2009 study found that areas with high income inequality were targeted for civil forfeiture operations, likely because these police departments have limited funding and are inclined to use forfeiture to secure needed revenue.

In Alabama, it is possible to lose a car or cash if police find a marijuana cigarette during a routine traffic stop. Forty-two percent of all the civil asset forfeiture proceedings across the 14 counties studied for this report relate to marijuana offenses. In 18 percent of cases where criminal charges were filed, the charge was simple possession of marijuana and/or paraphernalia. And the median amount taken was about $1,300 – less money than it would typically cost to hire a lawyer to recover it, and certainly not the kind of cash associated with the kingpins who are civil asset forfeiture laws’ intended targets.

The “Equitable Sharing” program

Despite the light burden of proof and high likelihood of obtaining a default judgment in state court, Alabama law enforcement officers often prefer to funnel civil asset forfeitures through the federal government’s “equitable sharing ” program, where an astonishing 88 percent of civil asset forfeiture cases go uncontested.

In fiscal year 2015, Alabama state, local and joint agencies were awarded $3.1 million in cash and sale proceeds through the program – approximately $816,000 more than they received in state court proceedings.

Between 2000 and 2013, Alabama law enforcement agencies took in more than $75 million in DOJ equitable sharing funds.

Equitable sharing can proceed in two ways, neither of which requires a criminal conviction or even a charge.

The first is when assets are seized by joint task forces that include both state and federal officers, making these assets eligible for equitable sharing. Between 2009 and 2014, according to the DOJ, the vast majority of assets obtained through equitable sharing were taken through this process.

The second is by “adoption,” which allows Alabama law enforcement officers, at their discretion, to request that federal authorities take control of assets seized under state law and outsource the forfeiture to U.S. attorneys to litigate. When favorable judgments are obtained under either method, the federal government returns up to 80 percent to the Alabama agency that initiated the seizure.

In January 2015, then-U.S. Attorney General Eric Holder issued guidance prohibiting the use of adoption in most instances. However, his successor, U.S. Attorney General Jeff Sessions, rolled back these protections in July 2017, saying the shift would “make us more effective at bankrupting organized criminals and at safeguarding the property of law-abiding Americans.”

Despite Sessions’ assertion, there is ample reason to question whether civil asset forfeiture is an effective crime-fighting measure.

The most recent drug policy report from the Government Accountability Office, subtitled “Lack of Progress on Achieving National Strategy Goals,” points to its failures. In one recent study, researchers found that, while there is some statistical support for the idea that forfeiture leads to increased crime clearances, the impact is so small as to be immaterial. “The results,” they conclude, “undercut the argument that police retention of forfeiture funds is an essential element in the fight against crime.” Indeed, in a March 2017 report, the DOJ’s Office of the Inspector General found that in 56 of 100 Drug Enforcement Administration forfeiture cases it examined, “there was no discernible connection between the seizure and the advancement of law enforcement efforts.” Many of Sessions’ fellow Republicans, including Reps. Justin Amash (Mich.), Tim Walberg (Mich.), Jim Sensenbrenner (Wisc.) and Mark Sanford (S.C.), and Sens. Rand Paul (Ky.), Mike Lee (Utah) and Mike Crapo (Idaho) – along with a host of Democrats – disagreed with Sessions’ approach. Following his reinstatement of adoption, they condemned the practice or introduced various bills and budget amendments intended to severely restrict or end the practice.

Forum shopping

Equitable sharing presents an opportunity for forum shopping, where litigants seek to bring their case in the venue where they think they have the greatest likelihood of success.

Prior to the 2015-2017 suspension of federal adoption, Birmingham law enforcement agencies routinely sought adoption. Some officers made a practice of calling federal agencies from arrest scenes to seek permission to have the takings adopted, says former Assistant Jefferson County District Attorney Jerome Dees, who worked on civil forfeiture cases. Federal agencies encouraged this habit by cultivating relationships with local law enforcement agencies, he said.

At the same time, Dees said, Birmingham judges’ stricter-than-average view of the meaning of “reasonable satisfaction” meant that some forfeiture efforts failed, with property being returned and judges scolding police for seizing it in the first place.

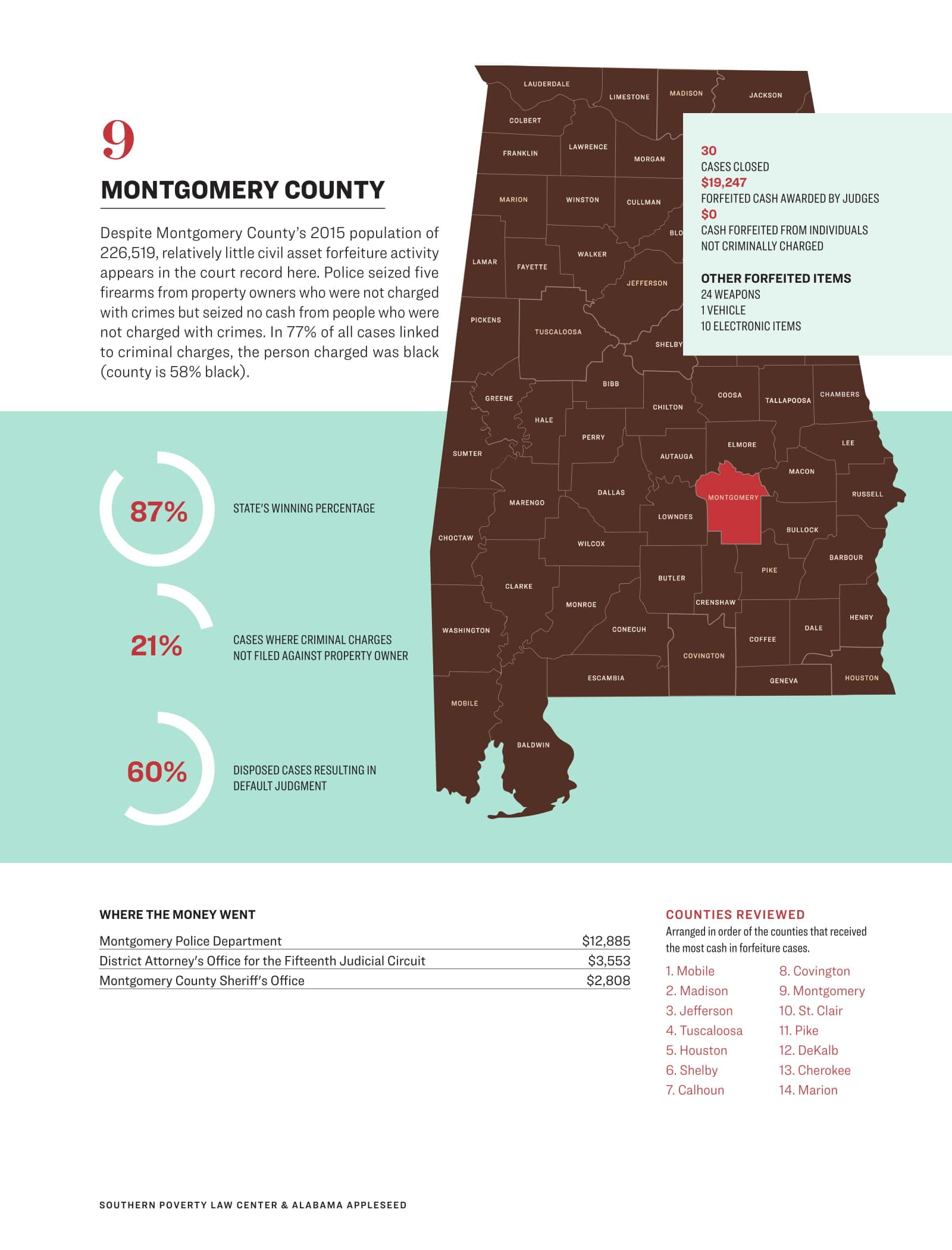

Montgomery judges, in general, reportedly also take a strict view of property rights, leading law enforcement agencies there to prefer federal venues for forfeiture cases. Sometimes, they called federal agents from the scene of a seizure to spirit the money away for adoption. Other times, “cross-designated” officers serving simultaneously as state and deputized federal agents, stopped people under state law and seized their money under federal law.

Joe M. Reed, a Montgomery attorney who has represented dozens of clients in civil asset forfeiture proceedings, has challenged both practices and describes adoptive forfeiture as an “illicit money-laundering scheme perpetrated by federal and state law enforcement agencies.”

Anyone can have their assets seized under civil forfeiture. But as is generally true in the American criminal justice system, the law itself might be color blind, but that doesn’t guarantee that enforcement is.

A 2017 study of traffic stops from 16 states for which data was available showed that African-American and Hispanic drivers were more than twice as likely as white drivers to be searched in conjunction with traffic stops. African Americans are also more likely than whites to be arrested for using drugs, be jailed while awaiting trial, be offered plea deals that include prison time, be struck from jury pools, serve longer sentences for the same offense, be disenfranchised because of felony convictions, and have their probation revoked.

In Alabama, African Americans make up 54 percent of the prison population but only about 27 percent of the state’s population. They are over-represented in jails at roughly the same rate. And, they are four times as likely as whites to be arrested for marijuana possession, despite research showing the two groups use marijuana at roughly the same rate.

Based on both the limited data on race in this study and interviews with lawyers who represent clients in civil asset forfeiture cases in Alabama, there appear to be racial disparities at work in the use of civil asset forfeiture as well.

Because race is not routinely reported in civil cases, it is impossible to determine the racial breakdown of all individuals whose assets were subject to forfeiture proceedings. However, the study found that in 64 percent of the cases that involved criminal charges, the defendant was African-American, even though African Americans comprise only about 27 percent of Alabama’s population.

Chase Dearman, a Mobile attorney, estimates he has represented more than 50 people in civil forfeitures cases. In one of Dearman’s cases, police seized tens of thousands of dollars from a black man who had just cashed a roughly $100,000 check from a worker’s compensation settlement. The money was still wrapped in bank tape and was contained in a box along with correspondence from the attorney who had represented him in the matter. Police took the money anyway after finding illegal drugs and paraphernalia on the property. Police also took the man’s TV sets; his fiancée’s sunglasses, purses and dresses; the couple’s couches and coffee table; and two paintings off the walls. The items were all eventually returned, though not until Dearman filed a motion to hold the police department in contempt for failing to comply with the court’s order finding the property was not connected to criminal activity.

Another of his African-American clients had money, electronics, furniture and football memorabilia belonging to his cousin, a former University of Alabama football star, seized when police searched his home. Yet another had rent money taken from his wallet because police said he planned to sell pills for which his wife had a valid prescription.

“The law is not inherently racist, but I do believe the practical applications become that way,” said Dearman. “I have never had a Caucasian client who has had a narcotics officer unscrew the TVs from their walls and take them out the front door and confiscate them. However, it is a common occurrence with African-American clients.”

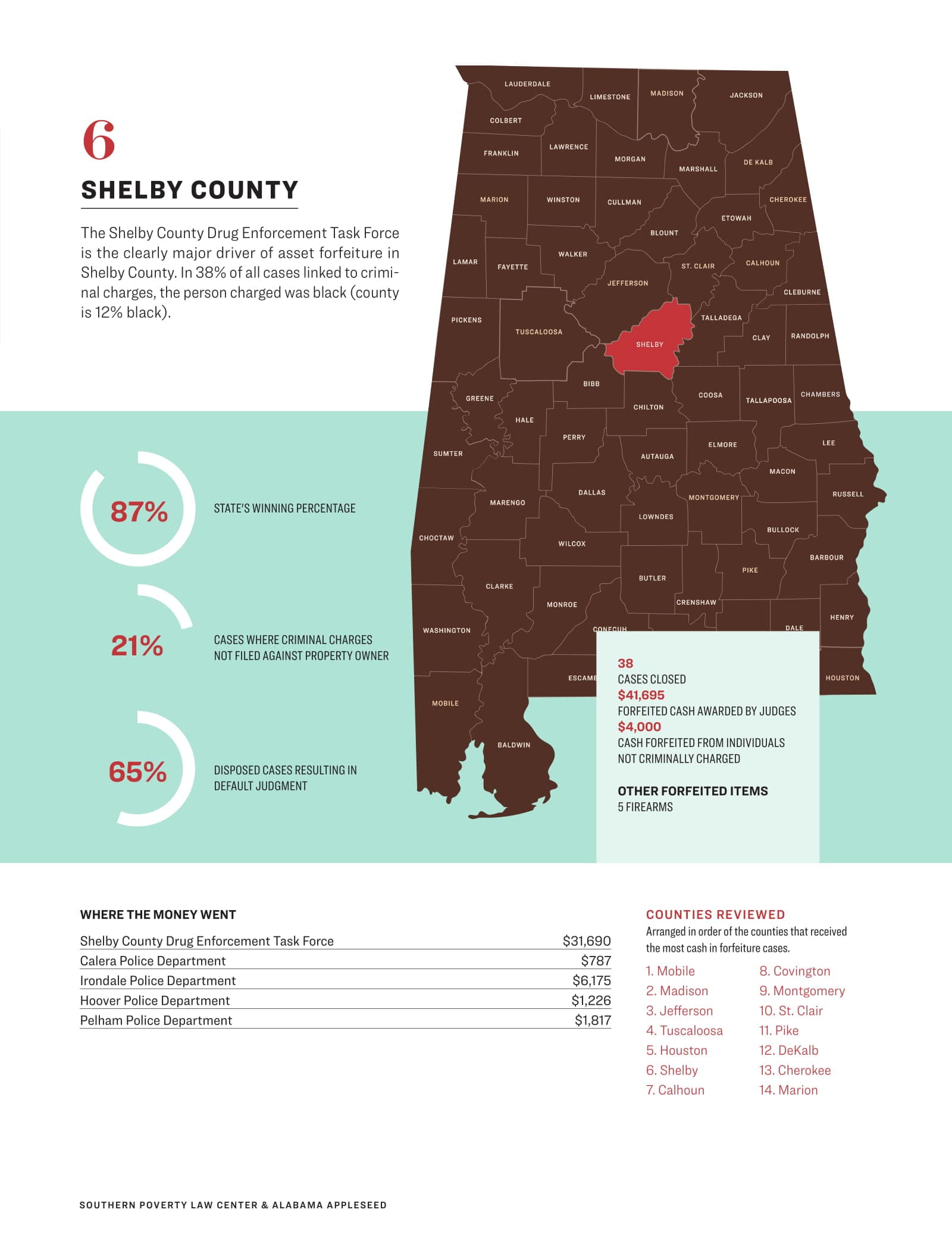

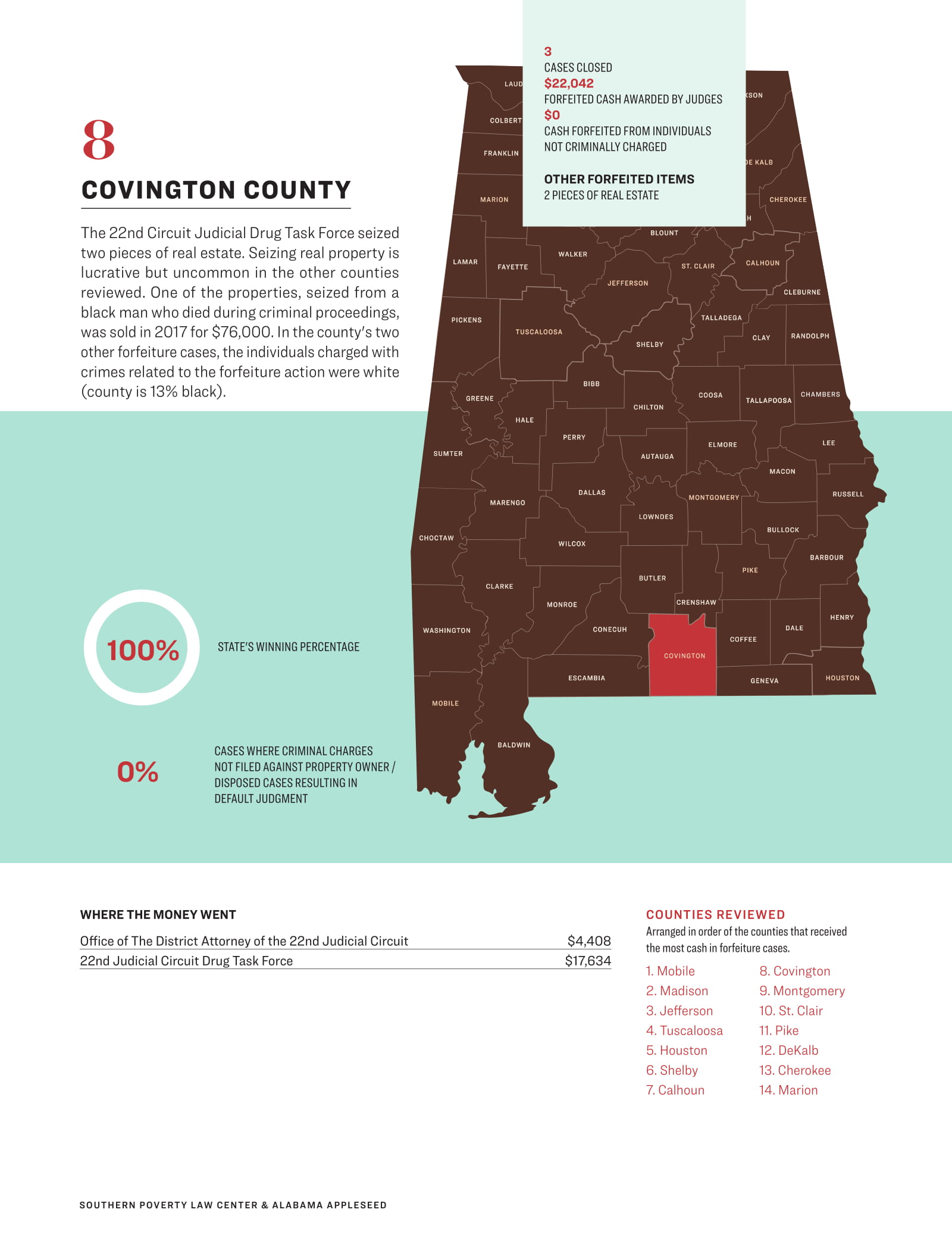

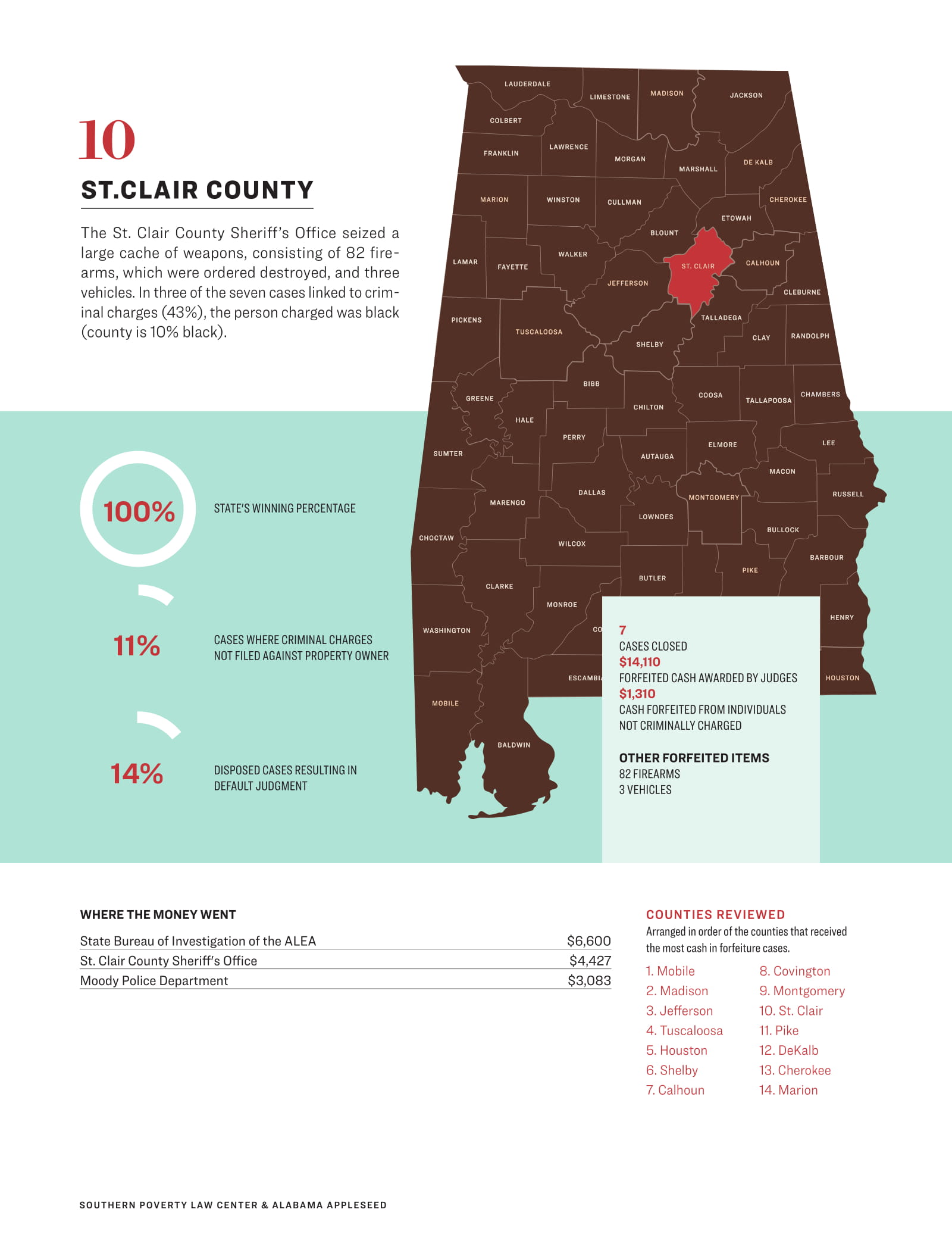

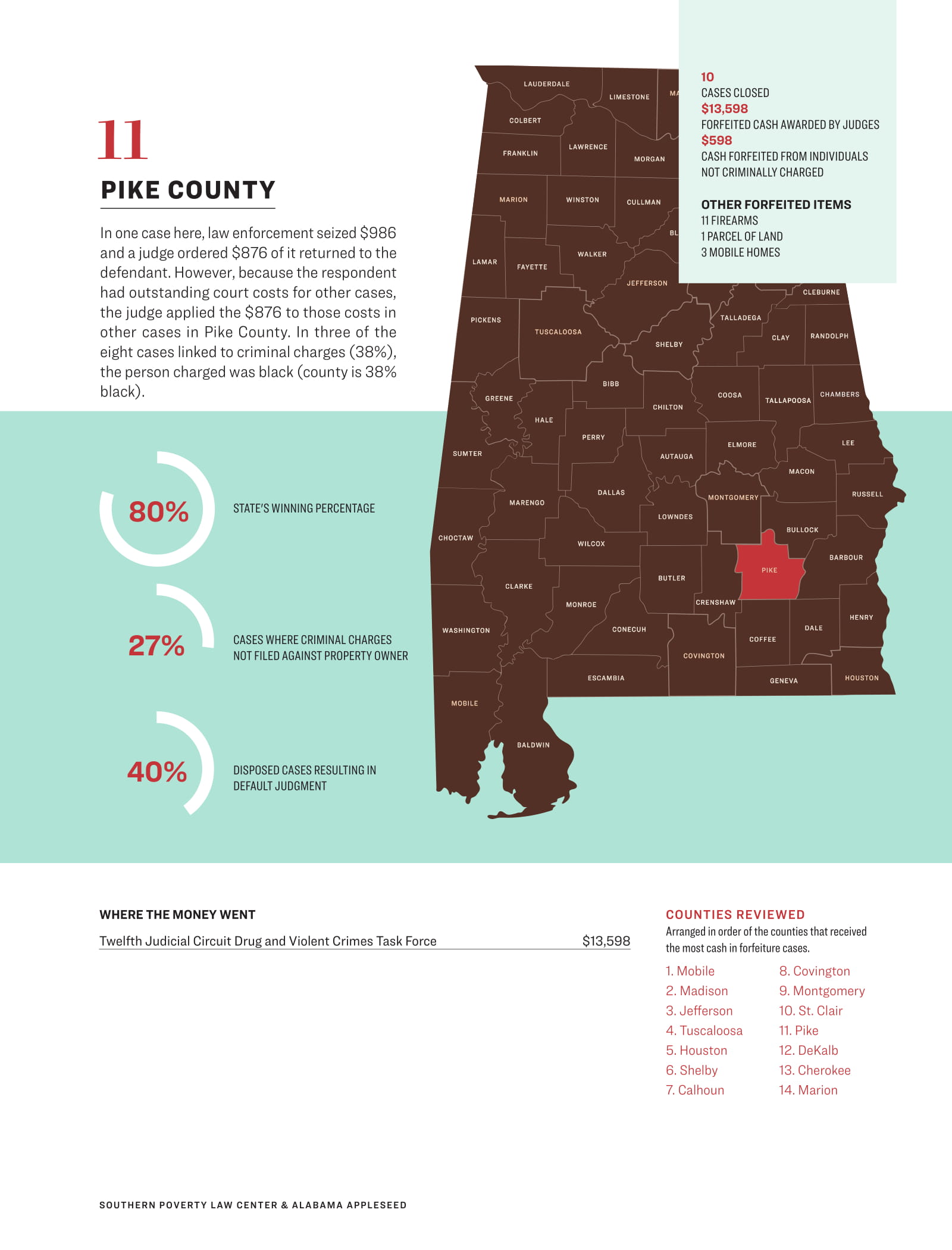

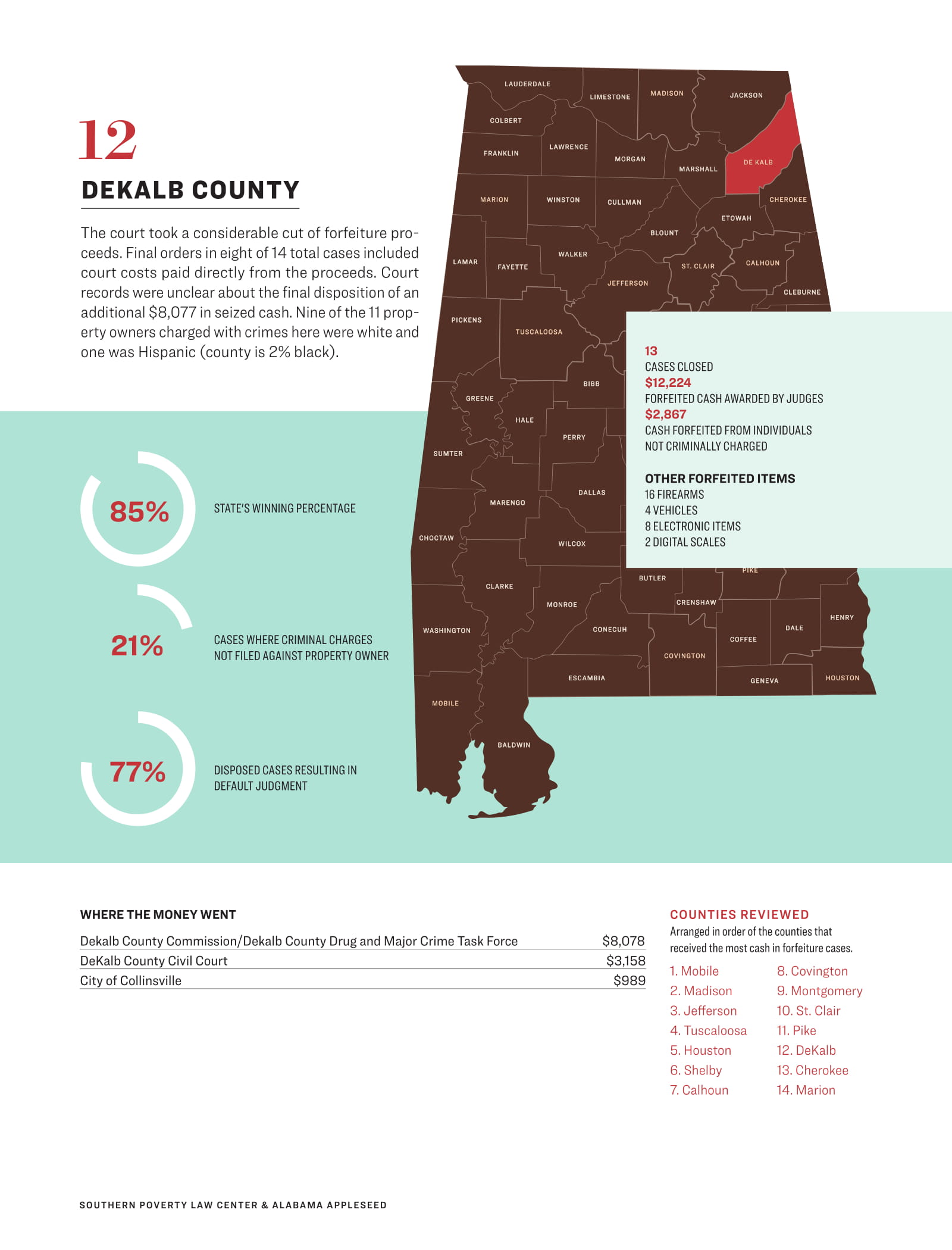

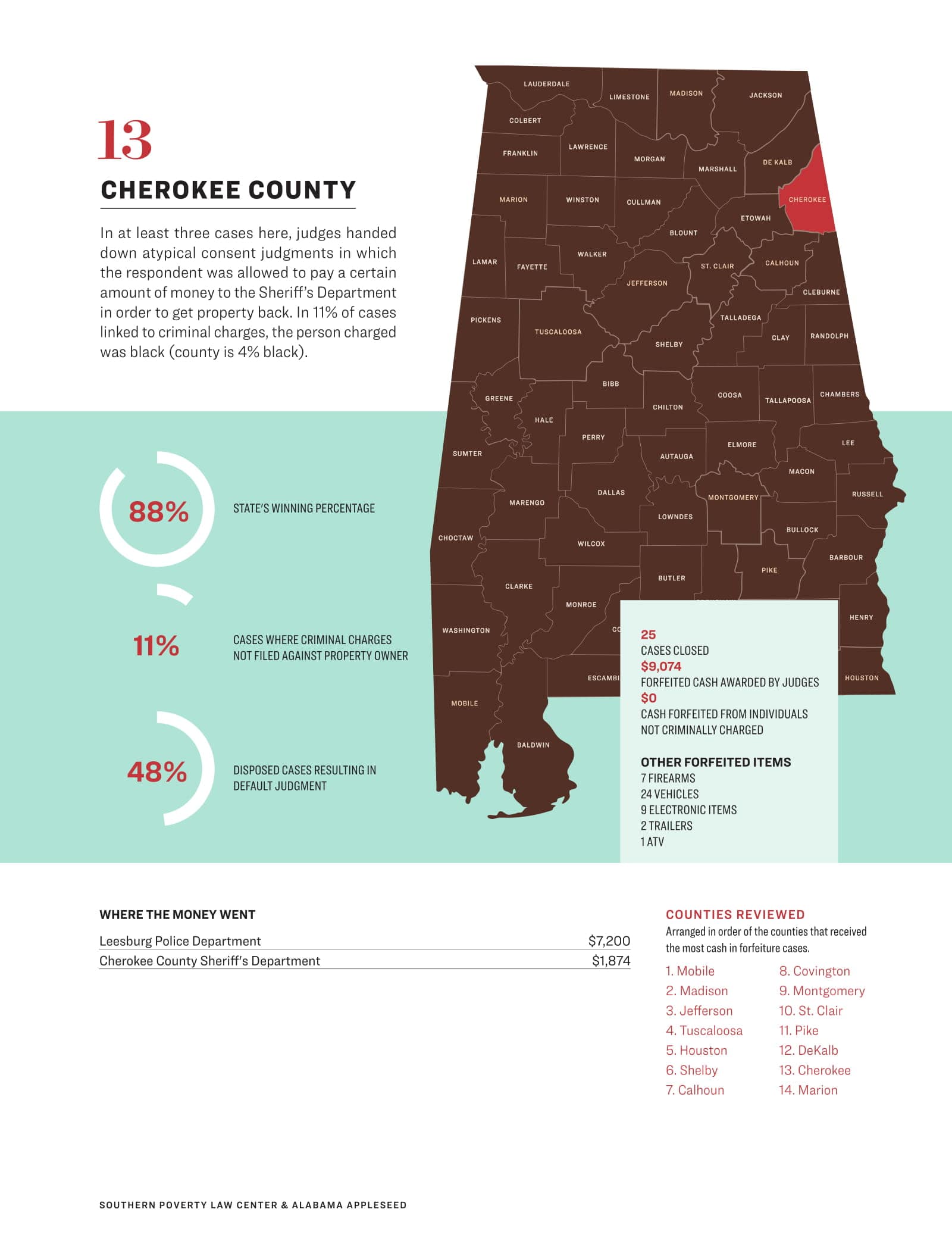

State prosecutors in Alabama filed 1,591 civil asset forfeiture cases in 2015, seeking approval from state courts to keep cash, vehicles and other items taken by officers from people they suspected of breaking certain laws. In many cases, those suspects were not charged with any crime. This study, based on court records, attempts to track the flow of money seized from Alabamians. It focuses primarily on 14 counties that represent the state’s major urban areas along with sample of rural areas with small populations. The cases filed in the 14 counties comprise 70 percent of the total number filed statewide in 2015.

The bounty

In the 14 counties studied, there were 1,110 civil asset forfeiture cases filed in 2015. Of those, 827 cases were resolved by October 2017 (75 percent), and the courts awarded a total of $2,190,663 in cash.

That money was divided among 70 different entities, mostly city and county agencies.

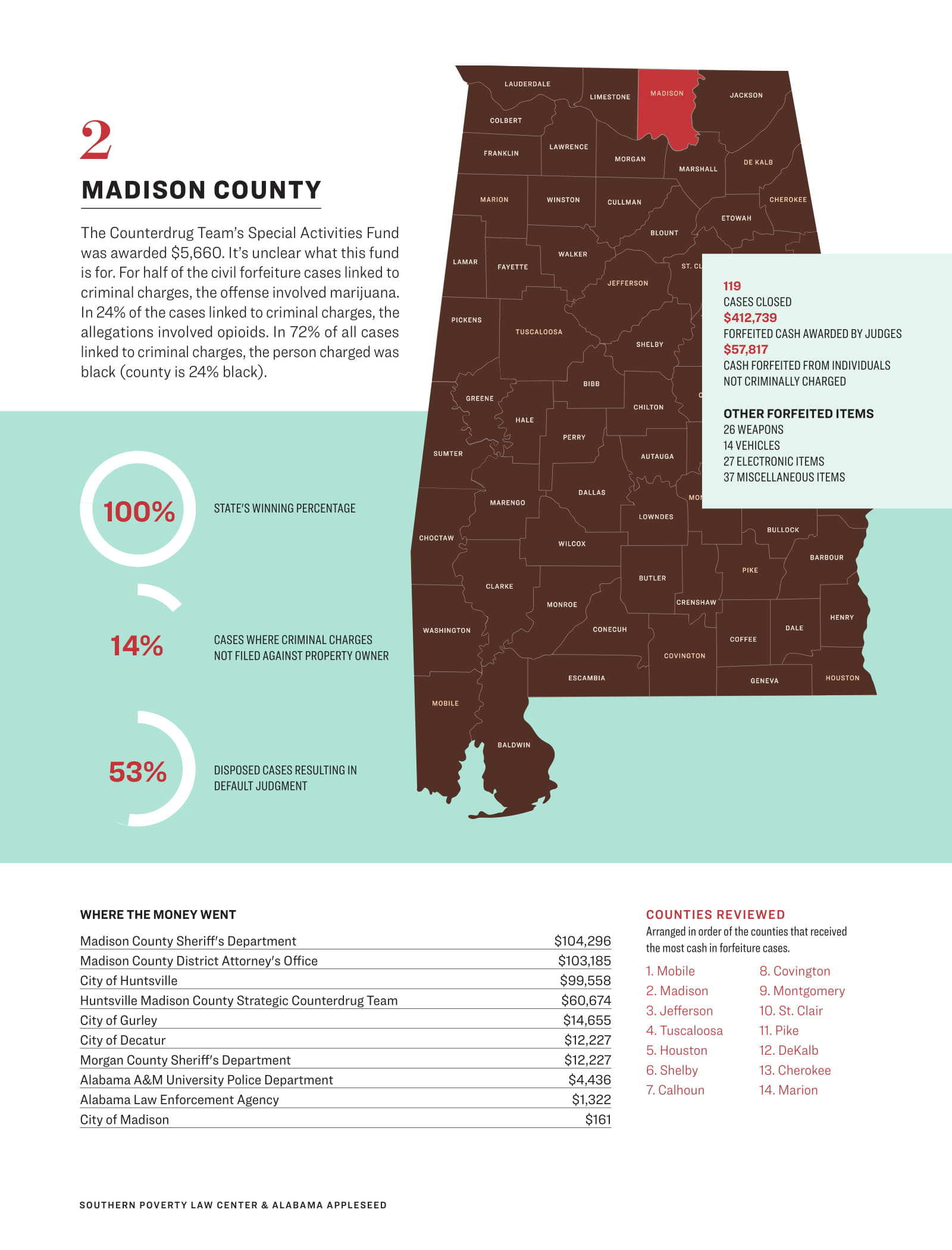

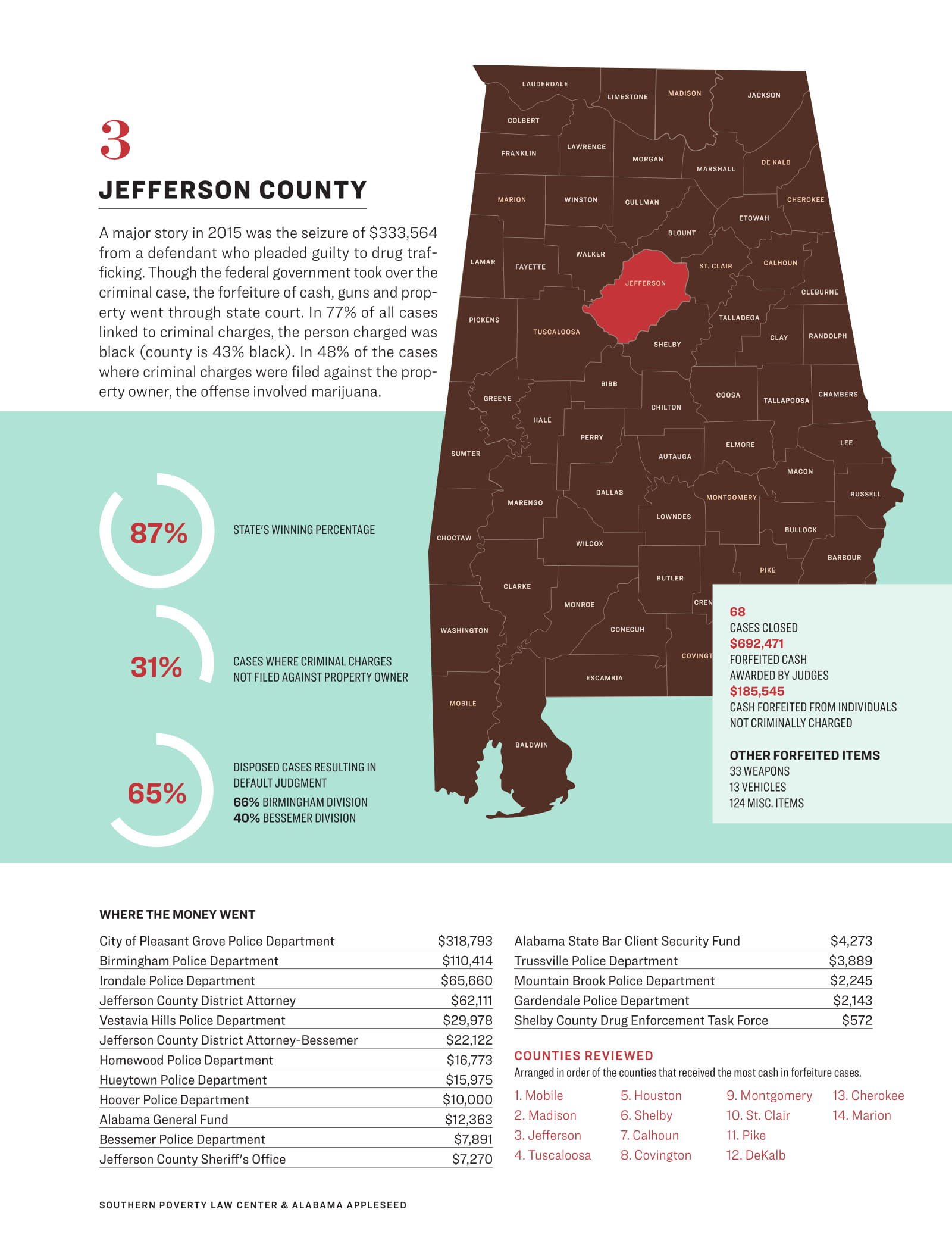

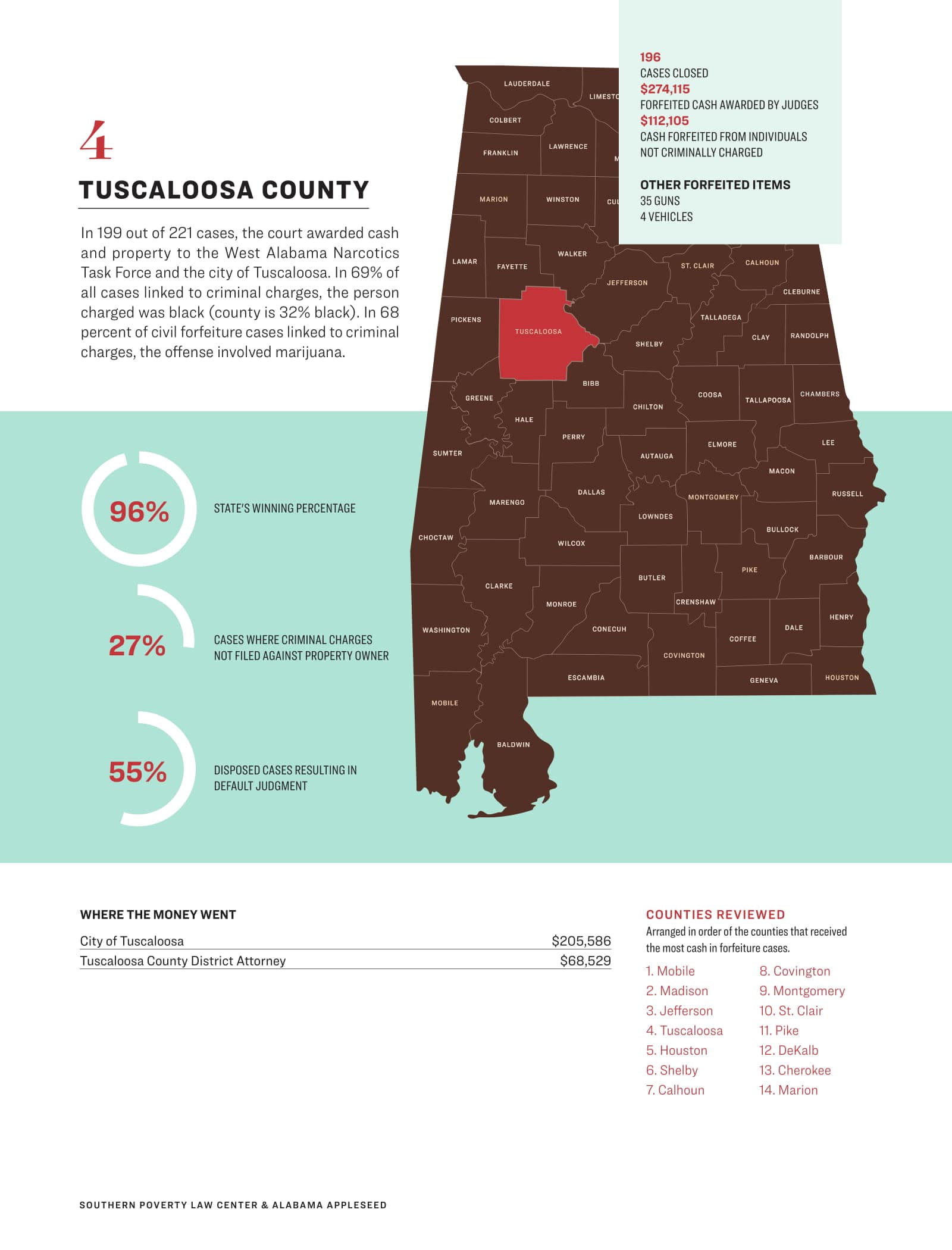

As might be expected, because of its size, the county with the largest amount forfeited was Jefferson ($692,471), followed by Mobile ($565,390) and Madison ($412,739).

Law enforcement agencies also were awarded 406 weapons, 119 vehicles, 95 electronics items and 274 miscellaneous items, including gambling devices, digital scales, power tools, houses and mobile homes.

Several district attorneys’ offices almost always took a cut of the proceeds – typically 20, 25 or 30 percent – in the cases they handled. Inter-agency drug task forces often received 75 percent or more of the money and property they seized. Courts sometimes essentially awarded themselves a cut of the forfeiture proceeds, ordering court costs and fees paid before passing the money along to the recipient agencies.

Here’s the breakdown of total cash award to each type of entity:

- Police departments, 42.3%

- District attorneys, 20.7%

- Cities, 15.2%

- Drug task forces, 9.7%

- Sheriff’s offices, 9.2%

- State agencies, 2.5%

- Other, 0.4%

In addition to this bounty, law enforcement agencies received $3.1 million in 2015 from assets seized in Alabama and forfeited in the federal courts through the Department of Justice’s “equitable sharing” program. That means that a total of least $5.3 million was taken from individuals in Alabama – many of them never charged with a crime – and used to supplement the funding of Alabama law enforcement in 2015.

The absence of a link to criminal charges

There is no requirement in Alabama law that a property owner be convicted of a crime – or even charged – in order for the state to forfeit cash or other property seized from that person.

In fact, in 25 percent of the 1,110 cases reviewed in this study, the person whose property was taken was not charged with a crime in connection with the seizure.

The state won the vast majority of those cases – 84 percent – and received $676,790 in cash from people who were not charged with a crime.

Marijuana crimes were a major driver of civil forfeiture proceedings:

- In 42 percent of all cases examined, the alleged offense was related to marijuana.

- In 55 percent of the cases that led to criminal charges, the offenses were related to marijuana.

- In 18 percent of the cases involving criminal charges, the charge was simple possession of marijuana and/or paraphernalia.

Read more in the SPLC's story "An Alabama man died. Then cash-strapped prosecutors fought his family for his house."

Stacked deck

In criminal court, prosecutors must prove “beyond a reasonable doubt” that the accused is guilty. But in most civil asset forfeitures, they must show only to the judge’s “reasonable satisfaction” that the property taken was in some way connected to certain illegal activity.

The state rarely loses.

Of the 1,591 cases filed in 2015 across Alabama, 1,196 had been resolved by October 2017. The state won 79 percent of those cases.

In more than half the disposed cases (52 percent), the property owner did not contest the forfeiture, resulting in a default judgment – an easy win – for the state.

This happens for several reasons.

Often, the value of the property involved, while it may be an important sum to the person from whom it is taken, is less than the amount of money it would take to hire a lawyer to contest the forfeiture in court. At the federal level, some studies have shown that nearly 90 percent of forfeitures are uncontested.

This study found that in half of the 1,110 cases examined in 14 Alabama counties, the amount of cash involved was $1,372 or less. That means that, in many cases, defaulting was the most economically sensible option.

Those who attempt to navigate the courts without a lawyer find themselves dealing with a system where pursuing their case can require multiple court appearances, while a single missed deadline or appearance can mean a default judgment in the state’s favor.

In some instances, individuals are in jail awaiting trial when they learn the state has laid claim to their property, or they may be too preoccupied with defending themselves against criminal charges.

Sometimes, they might not even know about the forfeiture proceedings. That’s what happened to Shannon Qualls, who, according to court documents, was locked up in the Calhoun County Jail for possessing marijuana and paraphernalia when he learned that his money had been forfeited by default. “I have become indegent [sic] and I am unable to come up with the funds to start this appeal,” he wrote in an April 12, 2016, letter to the Calhoun Circuit Clerk that became part of the court record. “I have no friends or family who could help me. And I was just wondering how can you confiscate some money with out [sic] being found guilty.”

Qualls went on to write that he never even received notice of the forfeiture proceedings: “I received only a forfeit letter 7 months latter [sic]. Please if you would please help me.”

The clerk couldn’t help him. Qualls’ money – $3,850 – had already been awarded to the Calhoun County Drug Task Force and the district attorney. Qualls pleaded guilty to marijuana possession six months later.

How was the money used by law enforcement agencies?

There is no state law in Alabama that requires law enforcement agencies to account for how they use the civil asset forfeiture process. They do not have to report the money they receive or how they spend it.

In an effort to obtain records that might show how the money was spent, Alabama Appleseed and the SPLC submitted public records requests to more than 100 law enforcement agencies, municipal entities and state departments.

The responses revealed little. Most of the agencies simply ignored the request. Some refused to provide any information.

A private attorney writing on behalf of the Montgomery County Sheriff’s Office, for example, called the request to see 10 years of financial data on civil forfeitures and other items “outrageous” and estimated it would cost approximately $100,000 in time and labor.

A deputy district attorney with the Birmingham division of the Jefferson County District Attorney’s Office wrote: “The State objects to the request as it would have an irreversible impact upon the security or safety of persons and disclosure of which would otherwise be detrimental to the best interests of the public.”

Pat Jones, the Houston County district attorney – whose office was awarded $17,380 in 2015 alone – said in a phone call that he had located a 2004 memo created by his predecessor saying the proceeds of forfeitures were to be split between the district attorney and law enforcement. He said he had no spreadsheets or other documentation about income from forfeiture proceedings. He promised to send the memo, but never did so.

Ashley Rich, the Mobile County district attorney, sent spreadsheets showing monthly income from forfeitures and the salaries she paid to staffers dedicated to handling civil asset forfeiture cases. She also provided a letter she had sent to a local police department to update it on a 2014 law expanding the circumstances under which property could be seized for civil forfeiture.

The city of Glencoe sent a handwritten fax reading, “We do not have any of this.”

A few agencies produced documents showing how the proceeds are divided among local entities. For example, an email from an assistant district attorney in the 12th Judicial Circuit, encompassing Pike and Coffee counties, said that forfeiture proceeds from the circuit’s Drug and Violent Crime Task Force can be “utilize[d]” in the “respective budgets” of the participating agencies.

One agency did provide much of the information requested.

An assistant to Michael O’Dell, district attorney for the 9th Judicial Circuit (Cherokee and DeKalb Counties), provided documents going back 10 years for the Cherokee County Narcotics Seizure Account, showing all deposits and payments from civil asset forfeiture proceeds. As of Nov. 3, 2017, the account contained $14,037. Payments included large checks to the sheriff’s department, as well as court costs, undefined “analysis charges,” usually totaling less than $30, and other items.

In cases filed in 2015, Cherokee and DeKalb agencies received a total of approximately $21,300, according this study. It’s unclear whether the account above included all of the funds received through civil forfeiture in the two counties.

O’Dell also sent a 2010 document, titled “Cherokee-DeKalb County Seizure Parameters,” that outlines when and how seizures should be undertaken in the jurisdiction.

In addition to setting out the conditions that would make a seizure defensible in court, the memo admonishes, “If it feels like you shouldn’t be allowed to seize the vehicle for the severity of drug crime you can prove in court, then don’t. For example, you shouldn’t be seizing a brand new Corvette just because you caught a guy with no known prior criminal history with a quarter-gram inside.”

With its well-documented potential for abuse and potentially devastating consequences, civil asset forfeiture is ripe for an overhaul. Indeed, many states have already implemented laws abolishing the practice or severely curtailing opportunities for misuse.

On the federal level, concerns over civil asset forfeiture have come from across the ideological spectrum. U.S. Supreme Court Justice Clarence Thomas questioned the practice in 2017, writing that the system “has led to egregious and well-chronicled abuses.”

The same year, Rep. Tulsi Gabbard, a Democrat from Hawaii, observed that civil forfeiture “does not discriminate between the innocent and the guilty” but instead “places the responsibility on private citizens to prove their innocence rather than put the appropriate burden on law enforcement to prove guilt.”

Animated by similar concerns, members of Congress have made numerous proposals for reform.

- In September 2017, the majority-Republican U.S. House of Representatives unanimously approved three amendments to an appropriations bill that would have completely defunded adoptive seizures and forfeitures. The bill’s fate was uncertain at press time, but in addition to receiving approval from every House member who voted, the amendments were supported by an unusual coalition of 24 organizations from across the ideological spectrum, including the Institute for Justice, the American Conservative Union, Americans for Prosperity, the American Civil Liberties Union, the Drug Policy Alliance and the NAACP.

- The Fifth Amendment Integrity Restoration (FAIR) Act, proposed by Sen. Rand Paul (R-Ky) and Rep. Tim Walberg (R-Mich), would abolish the federal equitable sharing program altogether, redirect forfeiture proceeds to the general fund, provide for attorneys for indigent individuals challenging civil asset forfeitures, and raise the standard from “preponderance of the evidence” to the much stricter “clear and convincing evidence.”

- The Deterring Undue Enforcement by Protecting Rights of Citizens from Excessive Searches and Seizures (DUE PROCESS) Act, proposed by Rep. Jim Sensenbrenner (R-Wisc.), would enhance protections for innocent owners and make other changes to the federal civil asset forfeiture system.

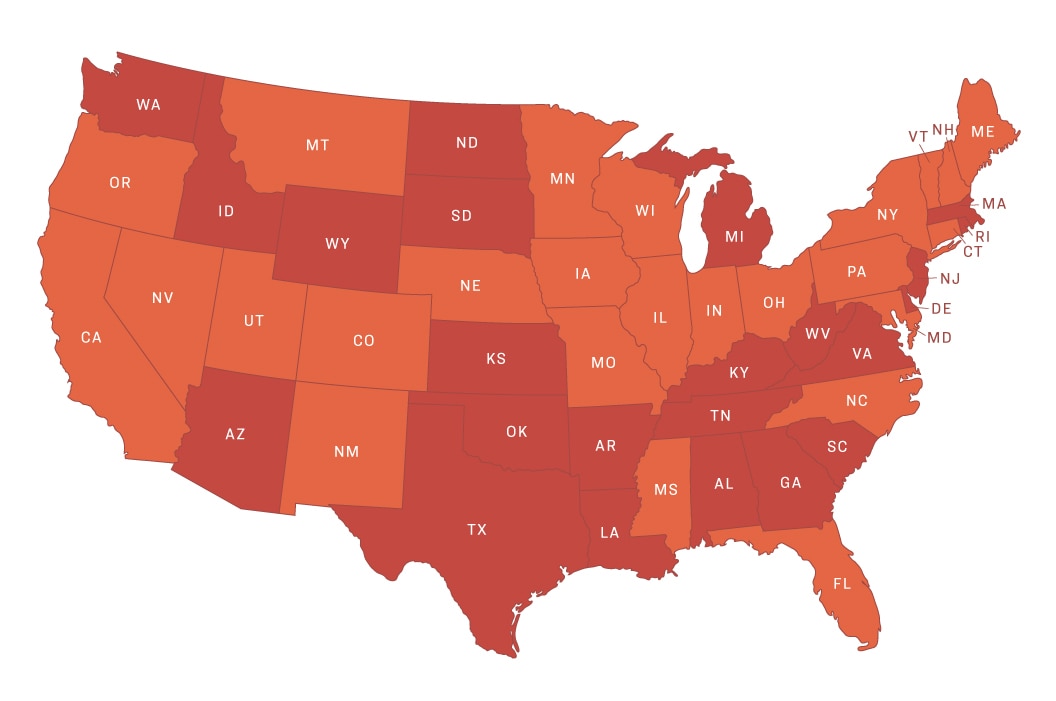

Many states have taken meaningful steps to reform their own civil asset forfeiture laws as well, by:

- Abolishing civil asset forfeiture: Nebraska and New Mexico have abolished civil asset forfeiture entirely, replacing it with criminal forfeiture, as proposed in the “Recommendations” section of this report.

- Raising the standard of proof: Many states have raised the standard of proof and linked civil asset forfeitures to criminal proceedings. States including California, Connecticut, Iowa, Ohio, Minnesota, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oregon and Vermont require criminal convictions (though not necessarily of the property’s owner) in most cases, with varying standards of proof for associated civil asset forfeiture proceedings.

- Protecting innocent owners: Fifteen states, including Mississippi and Florida, protect innocent owners by shifting the burden of proof to the government in all instances, in keeping with the notion of “innocent until proven guilty.” In Alabama, protection for innocent owners (people whose property is allegedly used by someone else in connection with criminal activity) varies depending on the statute under which the forfeiture proceeds.

- Reducing financial incentives: Indiana, Maine, Maryland, Missouri, New Mexico, North Carolina and Wisconsin, along with the District of Columbia, have reduced the financial incentives by completely redirecting forfeiture proceeds away from law enforcement coffers. And seven states plus the District of Columbia have passed laws severely limiting state and local agencies’ ability to participate in the federal equitable sharing program.

- Improving transparency: To acquire the facts and data that underpin this report, Alabama Appleseed and the SPLC spent hundreds of hours sorting through legal records and engaged a computer programmer to scrape information from Alabama’s subscription-only trial court database. But 14 states, including neighboring Georgia, plus the District of Columbia are required to put forfeiture records online, making it comparatively easy for the public to hold the government accountable for its forfeiture activity.

Alabama’s civil asset forfeiture process encourages policing for profit rather than the pursuit of justice. It opens the door to abuse and erodes trust in law enforcement. And, as this report demonstrates, it strips the due process and property rights from vulnerable individuals – many of whom may be innocent of any wrongdoing and without the financial means to defend against the forfeiture. It’s time for Alabama to end this exploitative practice and to protect the fundamental rights of its residents, as numerous other states have done. Lawmakers should enact the following recommendations to achieve this objective.

PROTECT DUE PROCESS AND PROPERTY RIGHTS

End civil asset forfeiture and replace it with criminal asset forfeiture.

Require that the forfeiture process occur within the criminal case. This mandate means the government must prove that the individual whose property was taken was actually convicted of a crime beyond a reasonable doubt, and that the property seized was the product of, or that it facilitated, that crime. This places the burden back where it belongs – on the state – and at the appropriate higher level of proof. And because individuals are entitled to counsel in criminal proceedings, it would ensure that no one would be forced to navigate a high-stakes legal battle without legal assistance. This step would protect Alabamians’ property rights while ensuring that government could still collect the proceeds of criminal activity.

Protect innocent property owners.

Create a process in which property owners can promptly challenge a seizure and/or assert that he did not know or consent to the use of the property in an alleged crime. Require the government to return the property to the owner unless it proves that the owner knew the property was the product of, or that it facilitated, the crime giving rise to the forfeiture. This change would protect the rights of individuals who had property wrongly seized, and protect innocent owners whose property was used in alleged criminal activity without their knowledge or consent.

CREATE TRANSPARENCY AND ACCOUNTABILITY

Mandate reporting.

Require annual, centralized reporting of all seizures and forfeitures and what law enforcement agencies spend forfeiture proceeds on. There currently is no requirement that law enforcement agencies report what they’ve taken from the public. It’s time for Alabama to bring sunlight to its forfeiture program.

REMOVE PROFIT MOTIVE

Disincentivize policing for profit.

Require the government to distribute forfeiture proceeds to the state’s general fund budget instead of allowing law enforcement agencies to keep them. This reform would help remove the profit motive from the practice of forfeiture, creating needed protection even under the unified criminal asset forfeiture process proposed in this report.

REIN IN FEDERAL ABUSES

Prohibit use of the federal civil forfeiture program.

Prohibit Alabama law enforcement from receiving proceeds from federal forfeiture actions. Like Alabama’s civil forfeiture program, the federal civil forfeiture program has a history of abuse. Until the federal government’s forfeiture programs include the basic protections recommended above, the best way to protect Alabamians’ due process and property rights is to prohibit receipt of proceeds from the program by Alabama law enforcement.

The data below was used to complete this report. It is available for download for external review.

PDF: How to read the data

Excel: Workbook 1 - All cases, Phase I & II totals, no-charge cases

Excel: Workbook 2 - Phase I county sheets