Editor’s note: This is the sixth story in the “Cuts & Consequences” series about the effects that federal spending reductions would have on people living in the Deep South.

When Donald Trump was sworn in for his second term in office on Jan. 20, he immediately began taking an ax to the country’s regulatory agencies along with diversity, equity and inclusion (DEI) programs, the Department of Education and the nation’s social safety net — and he did it fast.

One of his first executive orders created the Department of Government Efficiency (DOGE), which has been invading federal government offices, taking over key systems and firing or laying off government employees.

In large part DOGE, which is not an official federal department, has been dismantling the government’s ability to provide services and support to citizens who need the most help — those who are experiencing homelessness, who are experiencing food insecurity, elderly people and people in need of health care. While the question of whether those cuts are legal is still moving through the courts, the net effect of incapacitating or stopping government agencies and the support they provide is real.

Simultaneously, Congress has been debating the next federal budget. With control of both the House of Representatives and the Senate, Republicans have embraced the idea of downsizing government, but only the parts everyday Americans depend on. Republicans are pushing a budget that would strip families of health care, food, child care and education — to give more tax breaks to ultra-wealthy people and corporations.

The priorities of the current Republican majority — military spending, border security and extending the tax cuts from Trump’s first term that favor wealthy people — are visible in the framework documents passed through both chambers.

What’s missing from those documents are the programs designed to uplift people most in need of health care, housing assistance and help escaping poverty. Also missing are programs designed to protect the rights of Black and Brown people who have been disenfranchised for generations.

The current legislation shows no new support for those people set adrift as the functions of the government that they counted on for survival are being razed. The Senate bill called for about $4 billion in cuts (with a stated eventual target of $1.5 trillion in cuts) and a $5 trillion debt ceiling increase. That compares to the House’s more aggressive $2 trillion in cuts and a $4 trillion increase in borrowing authority.

Theresa Lau, senior policy counsel on eradicating poverty for the Southern Poverty Law Center, said the cuts won’t provide funds to repair the social safety net left shredded in DOGE’s wake.

“At a time when people are losing their jobs, facing high grocery bills, instead of prioritizing people with the greatest need, this administration and an unelected billionaire are putting assistance programs on the chopping block to give massive handouts to corporations and billionaires,” Lau said.

How much of the proposed plan survives judicial review and legislative horse trading, however, remains to be seen. As currently envisioned, the proposed extension of Trump’s tax cuts will likely benefit the wealthiest people. Those earning $1 million or more would see an average tax cut of $70,000, according to a study from the Urban-Brookings Tax Policy Center. A wage earner making between $65,600 and $116,400 a year — those whose income falls between 40% and 60% of all reported earnings — would see a $1,030 tax break on their 2027 taxes, according to the study.

Needed government support disappearing

The effects of the DOGE chainsaw can already be seen on the U.S. populace. Social Security offices across the South have closed. Support for communities in the wake of violent tornadoes, usually in the form of Federal Emergency Management Agency workers arriving to hand out checks and assist storm victims in navigating the federal bureaucracy, is absent. The federal government is threatening to withhold funding to schools at every level if they do not comply with eliminating anything that falls under the administration’s sweeping definition of DEI.

The administration reclaimed federal pandemic relief funds that states had been holding for later use. Local food programs are being defunded. Fair housing advocates are losing their grants. Staff responsible for helping families with low incomes afford heat and air conditioning were cut.

According to a tally from The New York Times, there have been at least 56,230 federal government employees cut — with almost three times that still to come.

Elon Musk, the world’s richest man and apparent leader of the DOGE effort, said he expected to find $2 trillion in taxpayer funds from government waste and excess by October. Then it was only $1 trillion. Last week, Musk said he expected to find $150 billion in fraud and waste.

But critics and watchdogs have questioned whether the claims of “fraud and waste” that DOGE has supposedly found so far are real.

The budget would likely not need to be cut at all if Congress had not continually lowered taxes for corporations and the nation’s top earners over the previous decades, according to the Center for American Progress, an independent, nonpartisan policy institute based in Washington, D.C.

“It’s not because we’re doing more,” said Bobby Kogan, senior director of federal budget policy for the Center for American Progress. “It’s because it costs more to do the same thing. We used to have a tax system, though, where our revenues would keep pace with [rising costs].”

What’s more, Kogan said many of the things being done in the DOGE effort are under judicial review and may be determined to be illegal.

However, the budgetary process in which Congress is currently engaged would provide a legal way to move funds, reassigning money withdrawn from programs like Medicaid, SNAP (the Supplemental Nutrition Assistance Program, also known as food stamps) and local food bank and foreign aid programs that provide markets for the nation’s farmers.

‘They want to pour more gasoline’

Aside from the relatively small numbers of the DOGE findings compared to the size of the federal bureaucracy, other questions have arisen over the outfit’s actions and results. The decades-long conservative movement to gut tax rates for high earners and corporations has weakened the nation’s ability to raise revenues, Kogan said.

“Even though we have these demographic changes, even though we have this health care cost growth, we used to have a system where the tax code was going to keep up with it,” Kogan said. “Debt to GDP (gross domestic product) would be stable and declining over the long run. And then what happened was we did very expensive tax cuts. And if we hadn’t done them, debt to GDP would be declining rather than rising.

“The story is we did expensive tax cuts,” Kogan said. “So, what are we looking at now? We see the Trump administration come in and blame spending, even though it [deficit growth] stems from tax cuts. They’re going after lifesaving overseas aid that is less than 1% of the budget.

“And then, while they’re doing a tiny bit over in this shrinking part of the budget, then they want to pour more gasoline on the tax cut side, right?” Kogan said. “They want to do even more tax cuts.”

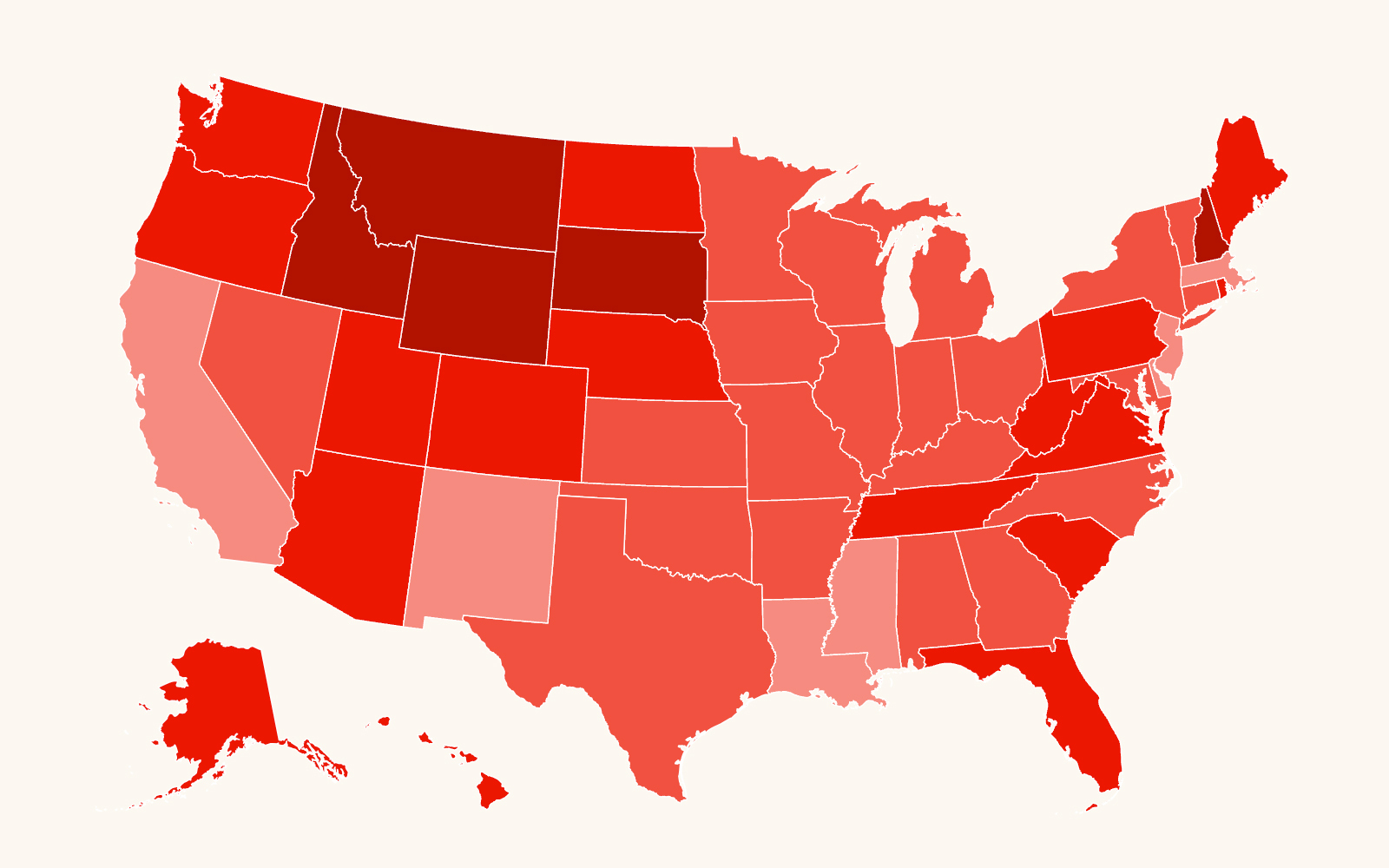

Image at top: Photo illustration by the SPLC. Original image by Katie Martin.