The SPLC joined 286 advocacy groups today voicing support for the Consumer Financial Protection Bureau’s (CFPB) proposal to restrict the financial industry’s use of forced arbitration – a tactic employed by Wall Street banks and predatory lenders to prevent consumers from challenging illegal practices in court.

In a letter submitted on the final day of the proposed rule’s public comment period, the groups lauded it as “a significant step forward in the ongoing fight to curb predatory practices in consumer financial products and services.” The CFPB will consider the public’s comments before issuing the final rule.

Banks and lenders bury arbitration clauses in the fine print of contracts to ensure that all customer disputes are decided by a private firm of the financial company’s choice, rather than by an impartial judge or jury. Most financial arbitration clauses also prevent consumers from joining class action lawsuits to challenge systemic abuses as a group.

“Forced arbitration leaves consumers with virtually no legal recourse to stand up to abusive lenders,” said Sara Zampierin, SPLC senior staff attorney. “It’s why we see these clauses in most lending agreements, including payday and car title loans. The CFPB rule will help ensure consumers can defend their legal rights. It gives them access to the courts and the ability to bring class action suits that can help eliminate the financial industry’s abusive practices.”

The CFPB proposed the rule in May after its comprehensive 2015 study found that forced arbitration virtually eradicates consumer claims. The letter’s signers praised the rule’s provisions to end class-action bans. While the CFPB’s current proposal would not end all forms of forced arbitration, consumer advocates agree it will “bring much-needed transparency to consumer financial arbitration” by establishing a public record of claims and outcomes.

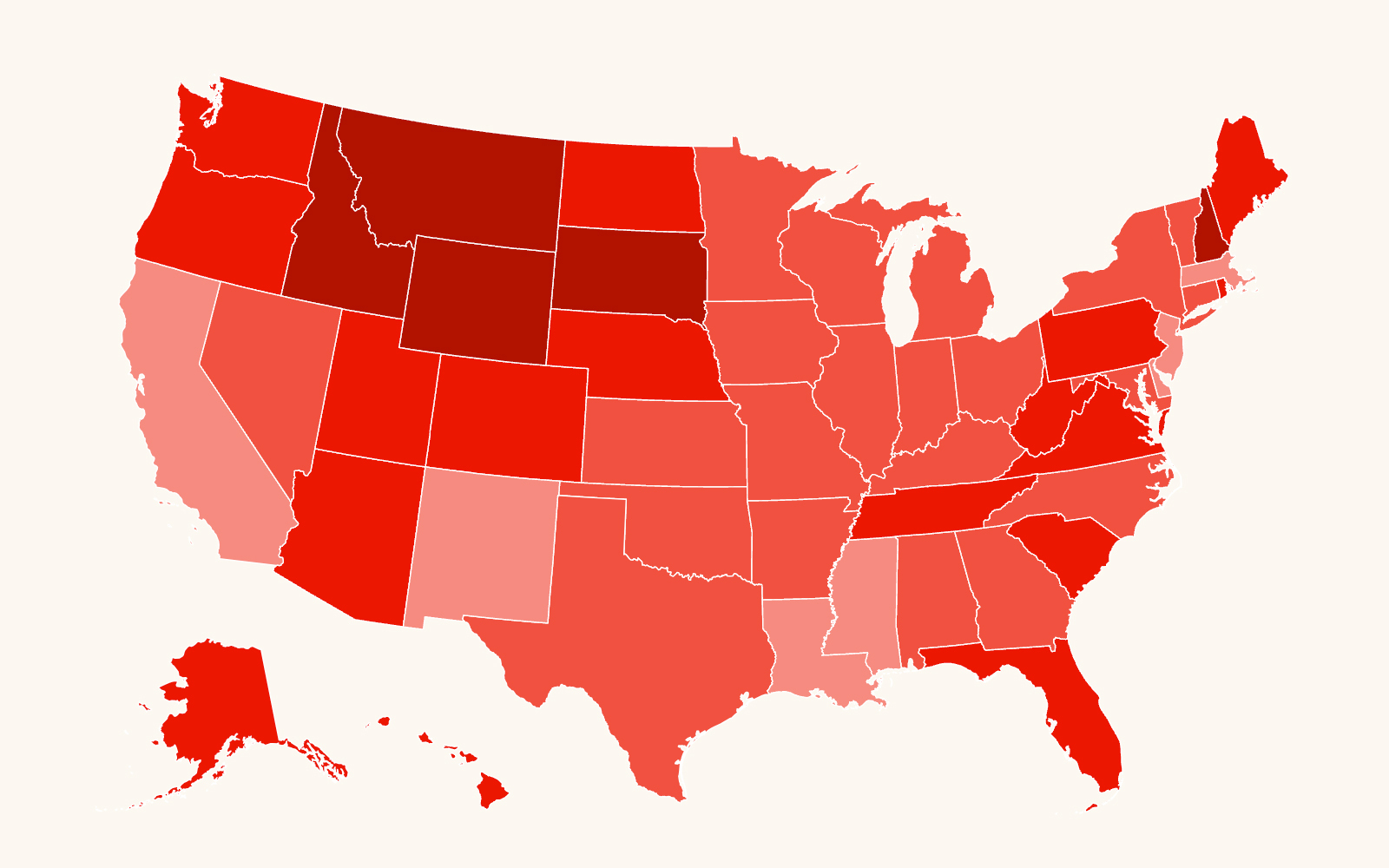

The CFPB’s proposed rule has generated more than 100,000 supportive comments from consumers across the country. It has also received support from over 100 members of Congress in separate House and Senate letters, 18 state attorneys general, state legislators from 14 states, and 210 law professors.