It was 18 years ago this week that Robert Ricks, a meteorologist with the National Weather Service, issued an ominous warning as Hurricane Katrina approached New Orleans.

“Most of the area will be uninhabitable for weeks … perhaps longer,” the note read. “At least one half of well-constructed homes will have roof and wall failure. All gabled roofs will fail … leaving those homes severely damaged or destroyed.”

That bulletin, issued at 10:11 a.m. on Aug. 28, 2005, also predicted that the suffering and effects from the storm’s damage would last weeks. But the native of New Orleans’ Ninth Ward, which was among the areas of the city inundated for weeks after levees failed in Katrina’s wake, could not have fathomed the depths of the hurricane’s ravages.

Many residents continue to struggle with the fallout from the catastrophe almost two decades later.

Some areas of the Gulf Coast that rested in Hurricane Katrina’s path can claim to have recovered, even grown, in the years since the tempest. But the 2020 census still shows New Orleans’ population is down 100,000 people from the 484,674 who lived there in April 2000.

After hurricanes Katrina and Rita, more than 130,000 Louisiana residents received more than $9 billion in funds through Louisiana’s Road Home program – a federally supported fund intended to rebuild after the disaster.

But due to systemic inequities, it has been far more difficult for Black and Brown residents to remain. Communities of color are more vulnerable to and less able to recover from natural disasters like hurricanes because of chronic underinvestment in their communities, racial segregation, redlining and racial wealth inequality. These factors push a disproportionate number of Black residents and renters into areas with crumbling infrastructure, poorer-quality homes and greater exposure to environmental hazards and contaminants.

Despite the influx of billions of dollars in aid and efforts to rebuild the city’s aging infrastructure, some residents – particularly in Black and Brown communities – are still struggling to rebuild.

Debt collectors

The Road Home program that was intended to help Louisiana recover from the storm damage exacerbated longstanding racial inequities. It shortchanged people in poorer, predominantly Black neighborhoods while giving people in wealthier, predominantly white areas more of what they needed to fully rebuild. People in the poorest areas of New Orleans were forced to cover more of their rebuilding costs under the program than those in wealthier areas, even though they had fewer resources.

To make matters worse, the state sued thousands of homeowners, alleging that they did not follow the rules in spending grants under the Road Home program. Debt collectors hired by the state came calling on the poorest residents, further hampering their efforts to recover.

It was not until February of this year that the U.S. Department of Housing and Urban Development (HUD) announced it was ending efforts to reclaim funds from homeowners who had received money through the Road Home program.

“Eighteen years removed, the pain and scars of Hurricane Katrina have never left us,” HUD Secretary Marcia L. Fudge said today. “We take the time to pause and remember those who died and lost their homes during this tragedy. This February, the U.S. Department of Housing and Urban Development stepped up to announce the closure of the Road Home program, which freed 3,300 Louisianans from repayment obligations. With the state of Louisiana’s compliance with HUD’s corrective action, the state released unpaid judgments and payment plans against homeowners in April of this year. Under President Biden’s and my leadership, HUD is righting a historic wrong and prioritizing the well-being of Louisiana families.”

Even though the problems with the Road Home program plagued communities for over a decade, it required multiple lawsuits to get federal leadership to recognize the issues hampering the recovery effort.

While HUD’s action helped many families get out from under the cloud of debt, the debt forgiveness did not change the struggle that many New Orleanians faced in the aftermath of Katrina and Rita. Nor did it heal the years-long uphill battle that the city’s Black and Brown communities faced in receiving aid compared to residents in predominantly white neighborhoods and suburbs of the city.

Horrors of the storm

When Ricks published his weather bulletin, it drew the eyes of the world to the Gulf Coast. For the next 48 hours, millions of people watched as the leviathan bulk of Katrina bore down on coastal Louisiana.

The storm shifted its landfall slightly, sparing New Orleans the direct hit that residents have always feared. But it still lashed the city through the morning hours of Aug. 29, 2005, bringing much of the destruction Ricks had forecast.

Because evacuation orders were not executed well in advance, many people – primarily poor people who could not afford to leave or who did not have vehicles at their disposal – found themselves trapped in the city. Thousands were brought to the Louisiana Superdome, which had been opened as a “refuge of last resort” as the storm approached.

Two 15- to 20-foot-long holes were carved into the roof as the relentless winds ripped the protective rubber coating off the facility. And although the Superdome had previously served as a storm shelter without losing power, Katrina knocked out all services to the arena.

But the roof held. After the horrors of the storm, residents started to think of returning to their homes.

That’s when the flooding began. Although the eye of the storm had passed to the east, sparing the city the stronger winds of its northeast quadrant, the damage to the wall of levees surrounding New Orleans left breaches in more than 50 places. To the west, a break at the 17th Street Canal allowed water to inundate the city’s West End. Other cracks along the London Avenue Canal and Inner Harbor Navigation Canal added to the flooding, which would result in 80% of the city being submerged.

To the east, the Mississippi River-Gulf Outlet levee was overtopped and breached in almost two dozen places. Those slashes through the protective levee left all of St. Bernard Parish, half of Plaquemines Parish and much of Orleans Parish, including New Orleans’ Lower Ninth Ward, underwater for weeks.

Because of the city’s historic tendency to flood, higher ground was priced at a premium. Many of the historic mansions, located along ridgelines and more elevated portions of the city, did not suffer with standing water for very long. The Vieux Carré, the city’s famed French Quarter, remained above water.

But in the neighborhoods where flooding was prone to happen, like the Lower Ninth Ward and New Orleans East, the water pooled. Over the years, the low elevation and tendency to flood meant that these neighborhoods were also the ones where Black families had settled, largely because of wage inequity and redlining practices that prevented them from purchasing in less flood-prone areas.

The world watched what happened next. The flooded homes. The festering waters. The rooftop rescues. The sick dying in hospitals.

By the time the city reopened, thousands of residents had been evacuated, displaced to other regions with no planning or goal other than getting them to dry land. Some who had evacuated prior to the storm remained where they landed, awaiting word on when they could return to evaluate the damage to their homes. Others looked to establish themselves in their new environment, part of a diaspora that spread New Orleanians across the nation.

Potholes on the Road Home

The first priority after Katrina was to save life and property. But exactly how to restart and rebuild the city was a constant, looming challenge. Even after the water was drained from the city’s streets and families could return, the destruction was so devastating that many chose not to come back.

Many of those who chose not to return were Black residents. Prior to Katrina, Black citizens made up 66% of the city’s population. That dropped to 59% post-Katrina. Of the 175,000 Black residents who left the city after the storm, only 100,000 came back.

In their place arrived a wave of white residents, according to a report from FiveThirtyEight, seizing the opportunity to create their own businesses in the vacuum the exodus left behind. That in turn drove up rent and other expenses in the city, making it less affordable for the Black and Brown residents who had been displaced by the storm.

The Road Home program was meant to help. It provided funds to supplement homeowners’ insurance, to elevate more than 13,000 homes, and provided additional mitigation measures for more than 39,000 homeowners. It also provided new housing for more than 8,500 families.

From the start, the Road Home program was panned for its treatment of Black residents. The Greater New Orleans Fair Housing Action Center filed suit against HUD, claiming that the methodology for estimating grant amounts was biased. A settlement was reached in 2011 that provided about 1,300 homeowners in four parishes $62 million in additional compensation.

But years after homeowners received this federal assistance to repair the damage and make properties more resistant to flooding, the state – which administered the program – attempted to collect from homeowners funds it contended were overpaid or misused.

State practices under scrutiny

When Fudge made the announcement in February clearing the debts, 700 homeowners had court judgments against them; 231 were subjected to repayment plans; and 2,365 homeowners were still party to active litigation about their debts, averaging $46,000 each. HUD’s actions to forgive unpaid debts gave families relief from the financial burden of ongoing payments and liens on their homes.

The relief reached individuals who still allegedly owed money or had other obligations, but no refunds were provided to people who already paid back debts that the state collected.

The debt collection practices on behalf of the state have also been under scrutiny. A pending lawsuit on behalf of Louisiana residents Iris Calogero and Margaret Randolph seeks to redress the harm they contend was caused by the state’s private debt collectors hired to collect alleged overpayments of Road Home grants. Calogero and Randolph allege that the state’s collectors violated the federal Fair Debt Collections Practices Act in attempting to collect what the state contended were duplicative payments. The plaintiffs are represented by New Orleans attorneys Margaret Woodward, Jenny Deasy and Keren Gesund, as well as the Southern Poverty Law Center.

The case, which seeks treatment as a class action for all affected residents, is now on appeal. The Fifth Circuit Court of Appeals will hear arguments in the case in October. This is the second trip to the federal appeals court following a 2020 decision in favor of the plaintiffs.

Some of those homeowners spent years paying on promissory notes and agreements they entered with the lawyers hired by the state to recover funds before HUD forgave these debts earlier this year. Randolph is one of those homeowners.

“I received my Road Home grant in the summer of 2007,” said Randolph, whose home in the Tremé/Lafitte neighborhood was damaged during Katrina. “In November of 2016, I received a letter from the Road Home, saying that I had been overpaid by $2,500, and that I needed to repay that amount.”

According to her court statements, Randolph consulted with an attorney and responded to the request but received no reply. A year later, a second letter was received, this time from a law firm, saying that not only did she owe the $2,500, but could also be liable for court costs and other fees.

“This letter terrified me,” Randolph said in her court filing. “I did not have $2,500, and I was afraid I was about to be sued and could lose my home.”

Randolph signed a promissory note, even though she did not believe she owed the money claimed, and sent her first monthly payment of $25 toward settling the debt in October 2017. Although her debt was forgiven by HUD earlier this year, the money she had paid to that point was not reimbursed. Her lawsuit is directed at what she contends were unlawful debt collection practices on behalf of the state.

Not done yet

Even with the time that has passed, the lessons of Katrina seem to have drifted away, much like the dirty, contaminated water that left the streets of New Orleans some 18 years ago.

Although steps have been taken to upgrade the flood protection measures in and around the city, the other issues that made return either impossible, impractical or undesirable remain.

The cost of housing continues to climb, soaring on the wings of gentrification, short-term rentals and remote workers who can live in New Orleans on wages earned from higher-paying jobs elsewhere. At the same time, other expenses like flood insurance continue to outpace all but the deepest of pocketbooks.

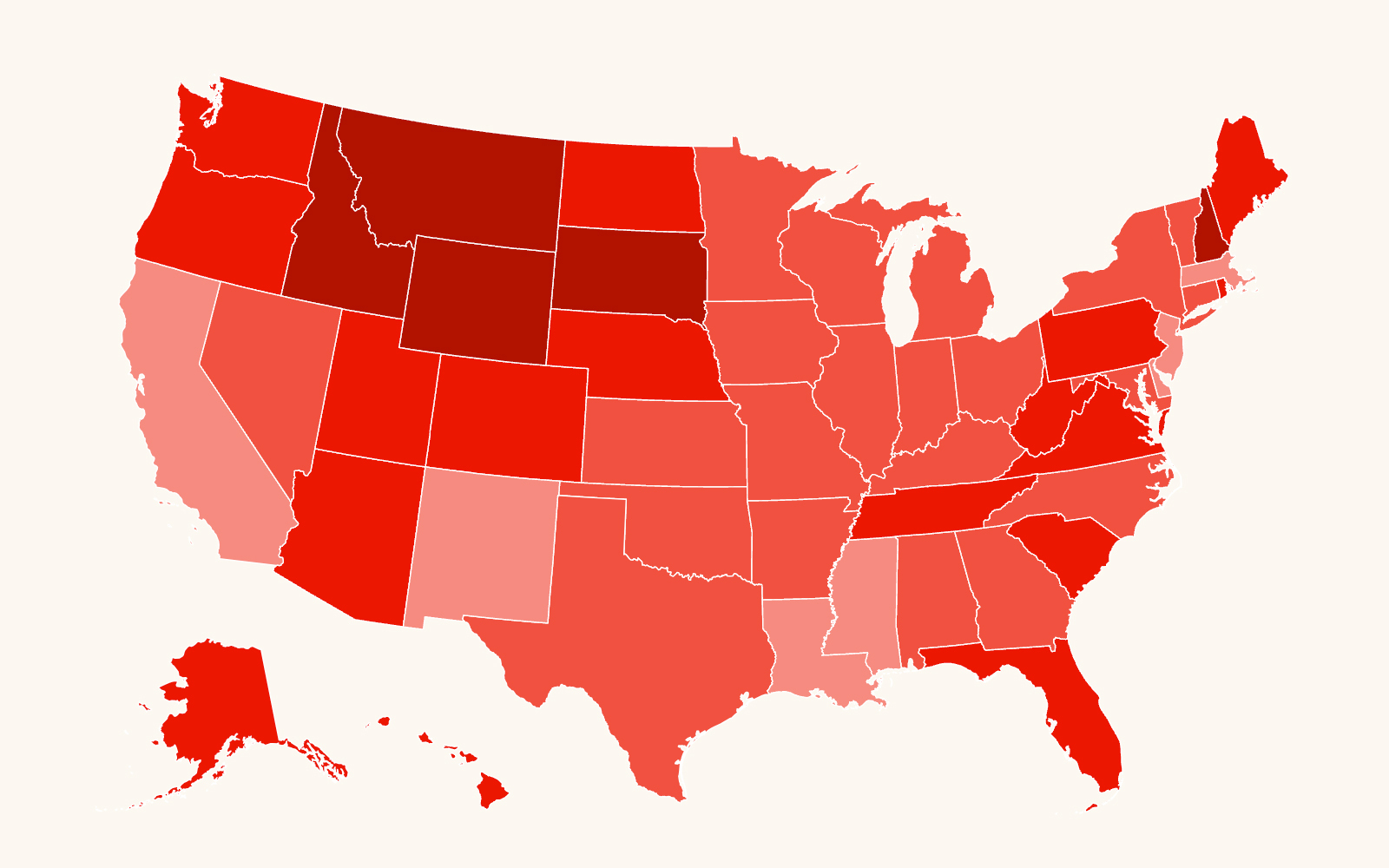

Over the last 10 years, Louisiana has had 18 climate disaster declarations. And when Hurricane Ida tore across the state in 2021, the response was familiar to many Black residents. Resources for recovery were not as readily available to Black and Brown communities. With power out for many days after the storm, most residents could not afford to wait out the return of utilities at a hotel, especially the oldest and poorest of the population.

Advocates of fair disaster relief argue that even after some legal victories, more action is needed to address the underlying inequities in housing and infrastructure that have been there even before environmental disasters hit.

It will be hard to fully repair the damage that has been done, first by the natural disasters and then by the years of mismanagement of disaster relief efforts under the Road Home program in Louisiana.

We applaud Secretary Fudge’s decisive actions to say “enough is enough” after listening to the people who were being harmed by this program.

Photo at top: Margaret Randolph’s home in the Tremé/Lafitte neighborhood of New Orleans. Randolph is a plaintiff in a lawsuit alleging harm from a law firm that engaged in collections of alleged overpayments of Road Home grants. (Credit: Dwayne Fatherree)