Gifts That Pay You Income for Life

Charitable Gift Annuities (CGAs) made to the Southern Poverty Law Center are a strategic way to ensure your own financial security and advance justice and equity for future generations.

Benefits of a CGA

- Secure, fixed payments for life (with rates currently as high as 10.1%) to you and/or another beneficiary. Your annuity payment will never change regardless of fluctuations in the stock market or interest rates.

- You can lower your taxes by receiving a federal income tax charitable deduction in the year you make your gift. Depending on your age, a portion of your annuity payments will also be tax exempt for several years.

- You can save on capital gains taxes if you fund your gift annuity with appreciated stock or mutual funds transferred directly to the SPLC.

- You can provide an income source for a spouse, family member, or loved one for their lifetime. (Age 60 is the minimum age to receive annuity payments.)

- You can choose when your payments begin to secure a higher payment rate. Your payment rate increases with each year you defer payments.

Important Notice: The SPLC requires a minimum gift of $100,000 to execute a gift annuity contract with first-time annuitants. A minimum of $10,000 is required from repeat annuitants. Repeat annuitants may also fund a gift annuity with a distribution from a Qualifying Charitable Distribution (QCD) up to $53,000 as permitted by the IRS. There is no tax deduction for a gift annuity funded from a QCD and all annuity payments are taxed as ordinary income.

How To Create a CGA with the SPLC

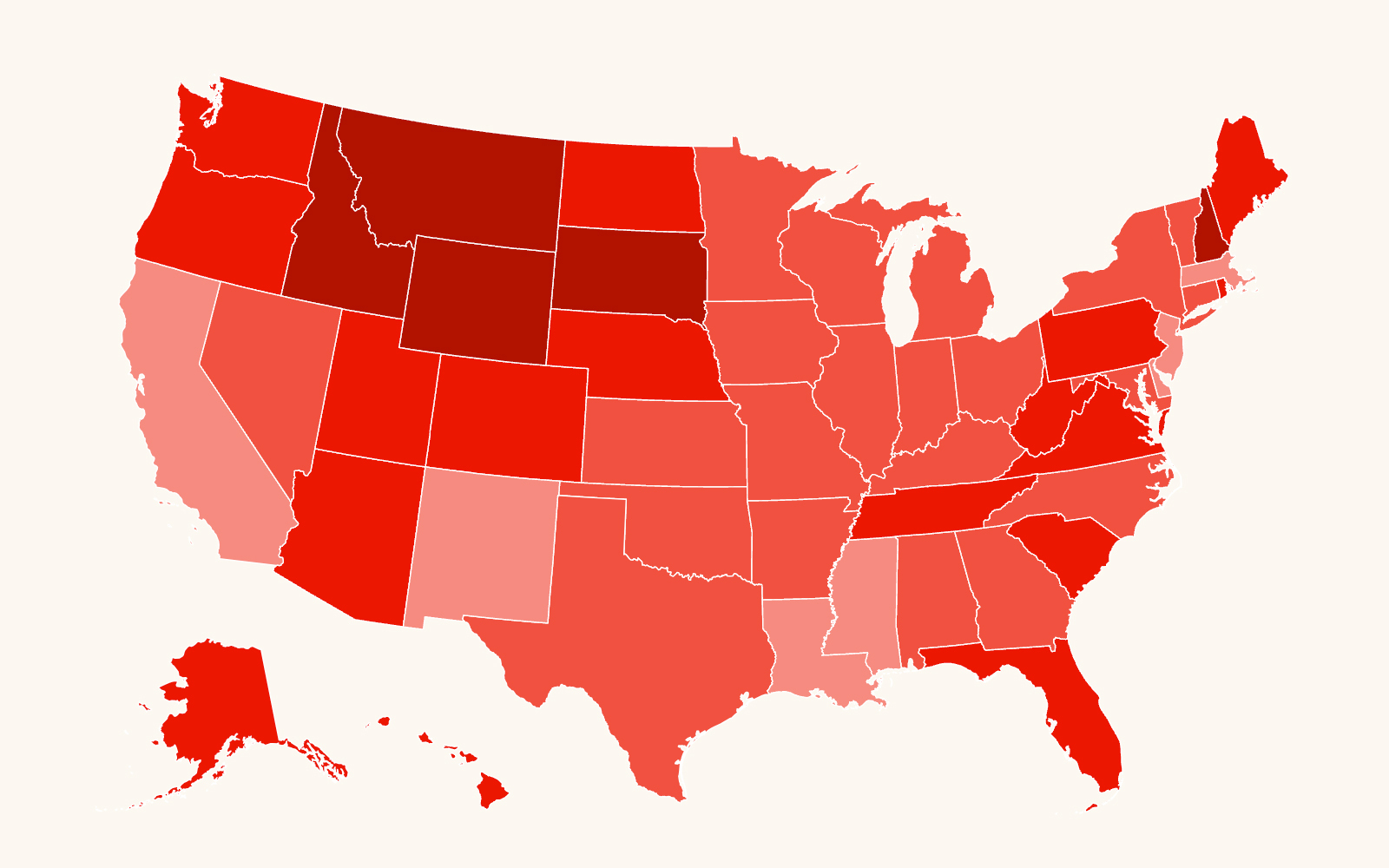

- Review the current annuity rates set by the Counsel of Charitable Gift Annuities for your age or age(s):

- Request a personalized illustration showing you your annuity payments and the tax deductibility of your gift.

- Complete the online Gift Annuity Application Form or download a PDF of the application.

Banking

The SPLC makes Gift Annuity payments through ACH transfers. If you’re a current SPLC gift annuitant and need to change banking information, please download the ACH Banking Form and follow the instructions. Please notify us six weeks in advance of your scheduled annuity payment.

For all other questions regarding the SPLC’s Gift Annuity Program, please contact us at [email protected].