The Sovereign Files: October 2017

Sovereign citizens are a diverse group of individuals whose activities and motives vary, but whose core tenets are the typically the same. They view United States citizenship, established government, authority and institutions as illegitimate and consider themselves immune from and therefore above the law.

A number of sovereign citizens engage in fraudulent activity, using paper terrorism to achieve their agendas and commit crimes under the mistaken hope or belief that laws do not apply to them. Some plan or take part in protests against government agencies and institutions, like the ones organized by the Bundy’s in Bunkerville, Nevada and the Malheur Wildlife Refuge in Harney County, Oregon. Some have resorted to violence, including acts of domestic terrorism when they felt their freedoms were infringed upon.

CALIFORNIA

Melissa Morton

Melissa Morton is the wife of fraudulent psychic and sovereign citizen Sean David Morton who repeatedly bilked the IRS and held seminars teaching others to do the same. David and Melissa were both found guilty of charges including conspiracy to defraud the United States.

Prior to sentencing Melissa sent a letter to judge Stephen Wilson claiming that she had been duped by a number of sovereign men, her husband being one of them. She described herself as just a “simple girl from Utah,” who was “dazzled and taken in by the glamour of “Hollywood,” saying “this girl from Utah was just not educated enough to know any different and believed her husband.” Melissa also wrote that she was reconnecting with her heavenly father and said that she needed brain surgery in the “not too-distant future.”

It is unclear whether her letter had any effect on her final sentence. On September 20, Morton was sentenced to 24 months in jail and ordered to pay $100 per count, which amounts to $2,800, along with restitution in the amount of $480,322.55. She also received additional conditions, which will go into effect when she is released. These include the stipulation that she cannot take part in any business that involves debt relief or the sale of financial instruments without her probation officer’s approval, and any and all of her business records and client lists must be accessible to them.

FLORIDA

Steven Lorenzo

Steven Lorenzo from Tampa, Florida was arrested for drugging and raping multiple men from the area. Later, when the state had enough evidence, he was charged with murdering two of them.

When the trial commenced, Lorenzo claimed to be a sovereign citizen, telling the court that laws do not apply to him, and choosing to represent himself. The judge in Lorenzo’s case has been skeptical of his decision, first asking Lorenzo if he knew what he was doing, then appointing a psychiatrist to assess his competency on October 30. Lorenzo refused to participate in the evaluation, but the judge made it clear that seeing the doctor was not a voluntary act.

The doctor is scheduled to present his findings to the court on December 4.

WASHINGTON

Tyre Wortham

Alleged bank robber Tyre Wortham is being tried in absentia after he claimed he was a sovereign, left the courtroom and refused to return or allow an attorney to represent him. Holding up sovereign documents while he wais interviewed in prison, he claims the court is committing treason. The court disagreed and moved ahead with his trial with an empty defendant’s seat and a jury that won’t be able to see him.

WEST VIRGINIA

Regan Dwayne Reedy

Regan Dwayne Reedy AKA “Wegani Diwaini Klandag Anisahoni” used a tax fraud scheme popular among sovereign citizens where they use the 1099-OID form to request refunds they did not qualify for. Many think this money is taken from their strawman accounts and given to them. It is unclear whether Reedy believed that, but he filed multiple 1099-OIDs. All but one of the false filings was caught by the IRS and no refund was issued. The one that went undetected, and was issued to Reedy was in the amount of $156,191.

Reedy and his wife also filed for bankruptcy twice, in 2012 and 2014. During these proceedings, Reedy concealed some of his assets from the creditors and lied during a meeting with them.

These activities landed Reedy in trouble with the Western District of Virginia where he was convicted of multiple tax and bankruptcy fraud violations.

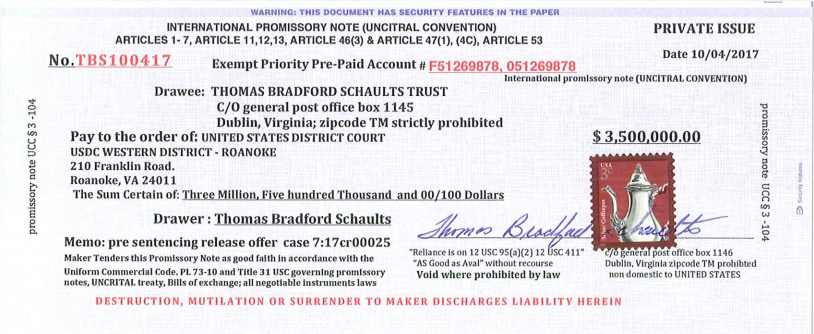

Not learning his lesson in the slightest, Reedy attempted to pay off the court pre-sentencing using his own International Promissory Note in the amount of $3,500,000. The court quickly added it to the evidence against him and will likely consider this particular action at sentencing.